key insights

-

Significantly high institutional ownership means that Schroders Real Estate Investment Trust's share price is sensitive to its trading actions.

-

Top 5 shareholders own 52% of the company

-

Ownership research combined with historical performance data can help you fully understand stock opportunities

To understand who actually controls Schroders Real Estate Investment Trust Limited (LON:SREI), it's important to understand the business's ownership structure. And the group with the biggest slice of the pie is institutions with 62% ownership. In other words, the group will receive the maximum benefit (or maximum loss) from its investment in the company.

Given the vast amounts of capital and research power at their disposal, institutional ownership tends to be particularly heavy for retail investors. Therefore, a significant portion of institutional funds invested in a company is usually a huge vote of confidence in the company's future.

Let's take a closer look to see what the different types of shareholders can tell us about Schroders Real Estate Investment Trust.

Check out our latest analysis for Schroders Real Estate Investment Trust.

What does institutional ownership tell us about Schroders Real Estate Investment Trust?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they usually consider buying larger companies that are included in the relevant benchmark index.

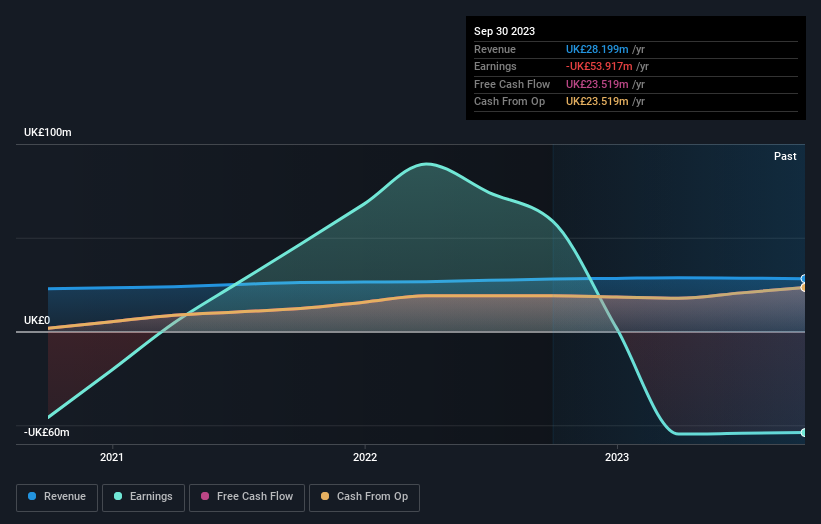

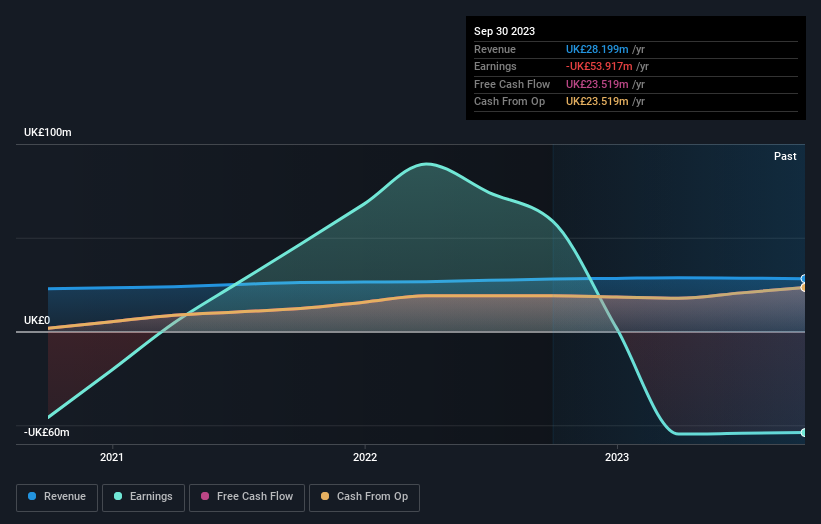

We can see that Schroders Real Estate Investment Trust has institutional investors. And they own a significant portion of the company's stock. This suggests some credibility among professional investors. But we can't rely on that fact alone because institutions make bad investments sometimes, just like everyone does. If multiple financial institutions change their view on a stock at the same time, you could see the stock price drop fast. So it's worth taking a look at Schroders Real Estate Investment Trust's earnings history, below. Of course, what really matters is the future.

Institutional investors own over 50% of a company, so when they come together they can strongly influence board decisions. Schroders Real Estate Investment Trust is not owned by hedge funds. Investec Wealth & Investment Limited is currently the company's largest shareholder with his 16% of outstanding shares. Meanwhile, the second and third largest shareholders hold 14% and 8.5% of the shares outstanding, respectively.

On further investigation, we found that 52% of the shares are owned by the top 5 shareholders. In other words, these shareholders have a significant say in the company's decisions.

While researching institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. . There is currently no analyst coverage of this stock, so this company is unlikely to be widely held.

Schroders Real Estate Investment Trust Insider Ownership

The definition of a company insider can be subjective and varies by jurisdiction. Our data reflects individual insiders, and at least captures board members. A company's management runs the business, but the CEO answers to the board, even if he or she is a member of the board.

I generally consider insider ownership to be a good thing. However, in some cases, it may be more difficult for other shareholders to hold the board accountable for decisions.

Our data suggests that insiders own less than 1% of Schroders Real Estate Investment Trust Limited's shares in their own names. It appears that board members only hold UK£160,000 worth of shares in the UK£220m company. Many small business investors want more board investment. You can click here to see if insiders have been buying or selling.

Open to the public

With a 31% ownership interest, the general public (primarily retail investors) has some influence over Schroders Real Estate Investment Trust. While this size of ownership may not be enough to sway policy decisions in their favor, they can still collectively influence company policy.

Public company ownership

We note that public companies hold 7.0% of Schroders Real Estate Investment Trust shares outstanding. We can't be sure, but it's very possible that this is a strategic interest. Businesses may be similar or may work together.

Next steps:

I think it would be very interesting to see who exactly owns the company. But to really gain insight, you need to consider other information as well. For example, we discovered that 3 warning signs for Schroders Real Estate Investment Trust (You can't ignore 2!) Here's what you need to know before investing.

If you want to check out another company with potentially better financials, don't miss this free A list of interesting companies backed by strong financial data.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.