One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article explains how you can use return on equity (ROE) to better understand a business. Learn by doing, and take a look at ROE to better understand Turners Automotive Group Limited (NZSE:TRA).

ROE or return on equity is a useful tool for evaluating how effectively a company can generate returns on the investment it receives from its shareholders. More simply, it measures a company's profitability in relation to shareholder equity.

Check out our latest analysis for Turners Automotive Group.

How is ROE calculated?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders' equity

So, based on the above formula, the ROE for Turners Automotive Group is:

12% = NZD 34 million ÷ NZD 280 million (based on the trailing twelve months to September 2023).

“Return” is the profit over the past 12 months. That means for every NZ$1 of shareholders' equity, the company generated NZ$0.12 of his profit.

Does Turners Automotive Group have a good ROE?

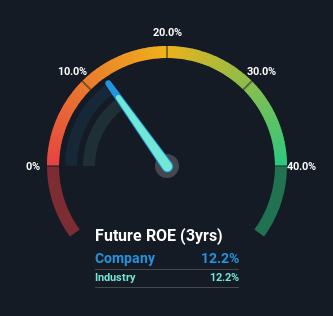

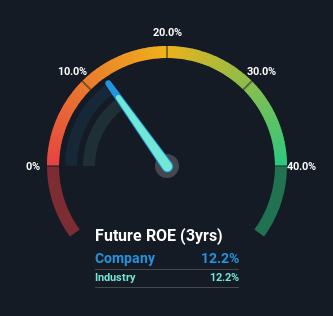

One easy way to determine whether a company has a high return on equity is to compare it to the average for its industry. A limitation of this approach is that some companies are very different from others, even within the same industry classification. If you look at the chart below, you can see that Turners Automotive Group's ROE is quite close to the average (12%) for the Specialty Retail industry.

That's neither particularly good nor bad. Even if a company's ROE is respectable compared to its industry, it's worth checking whether a company's ROE is supported by high levels of debt. When a company takes on a large amount of debt, there is a high risk that interest payments will be delayed. The risks dashboard displays the three risks he has identified for Turners Automotive Group.

How does debt affect return on equity?

Virtually all companies need money to invest in their business to grow profits. That cash may come from issuing equity, retained earnings, or debt. In the first and second cases, ROE reflects the use of cash for investment in the business. In the latter case, the debt required for growth boosts earnings but does not affect shareholders' equity. If we do that, our ROE will be better than if we didn't take out debt.

Turners Automotive Group's debt and ROE of 12%.

Turners Automotive Group's heavy use of debt is notable, with its debt-to-equity ratio of 1.49. It's hard to get excited about this business at the moment, as it has a fairly low ROE and heavy use of debt. Debt brings extra risk, so debt is only really worth it if a company generates some profit from it.

conclusion

Return on equity is one way that you can compare the quality of business of different companies. Companies that can achieve high returns on equity without taking on large amounts of debt are generally of high quality. If two companies have approximately the same level of debt-to-equity, but one company has a higher ROE, I usually prefer the company with the higher ROE.

However, if the quality of your business is high, the market will often bid up to a price that reflects that. You should also consider the rate at which earnings are likely to grow compared to the expected earnings growth reflected in the current price. So you might want to check out this free visualization of analyst forecasts for the company.

However, please note: Turners Automotive Group may not be the best stock to buy.So take a look at this free List of interesting companies with high ROE and low debt.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.