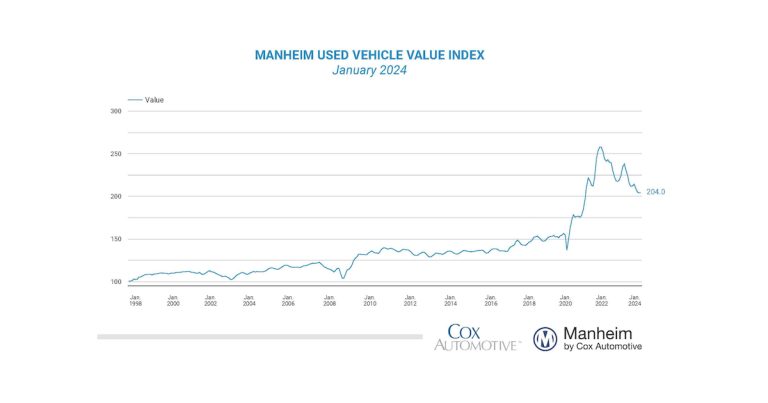

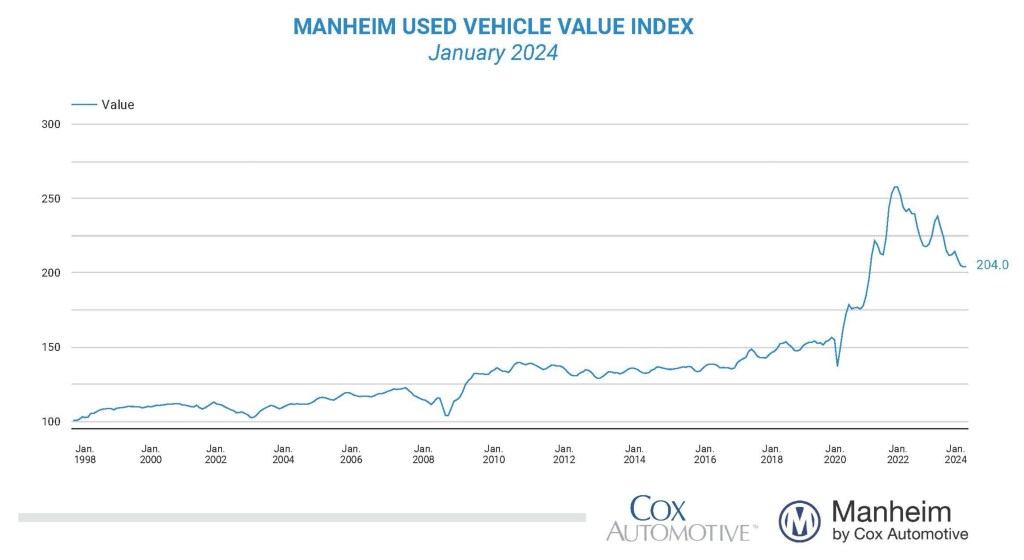

Used car wholesale prices (on a configuration, mileage, and seasonally adjusted basis) in January were unchanged compared to December. The Mannheim Used Vehicle Value Index (MUVVI) remained at his 204.0, but fell by 9.2% year-on-year. From December 2021 to January 2022, the index experienced the same monthly change of 0.0%.

“After all the volatility we've seen over the last year, this calmer month is a welcome sign for the industry,” said Jeremy Robb, senior director of economic and industry insights at Cox Automotive. “The first few weeks of January saw some price declines in the market before winter storms slowed wholesale market activity during the King's Holiday week. As activity picks up in the second half of the month , more purchasing activity was seen, leading to flat values in January. The 0.0% month-over-month change was stronger than the 0.2% decline typically seen in January. Tax Refunds Going into the season, we expect to see a bit more activity in the wholesale market, and we argue that 2024 should show more normal market trends throughout the year.”

The seasonally adjusted value offset the decline in the unadjusted value in January. The unadjusted price in January was down 0.2% compared to December, and the average unadjusted price was down 9.3% compared to the same month last year.

The Mannheim Market Report (MMR) value in January saw a decline above the weekly average for most of the month, but then leveled out in the following weeks. Over the past four weeks, the three-year index has fallen a total of 1.0%. His same four-week period saw an average decline of 0.1% from 2014 to 2019. During January, his daily MMR retention, which is the average difference in price to his current MMR, averaged 99.6%. This means the market price was slightly below his MMR. Values rose, but higher than they were at the end of the year. Average daily sales conversion rate increased to 56.0%. This shows that demand has improved compared to the end of the year, which is quite normal for this time of year. By the way, his average daily sales conversion rate in January over the past three years was 55.5%.

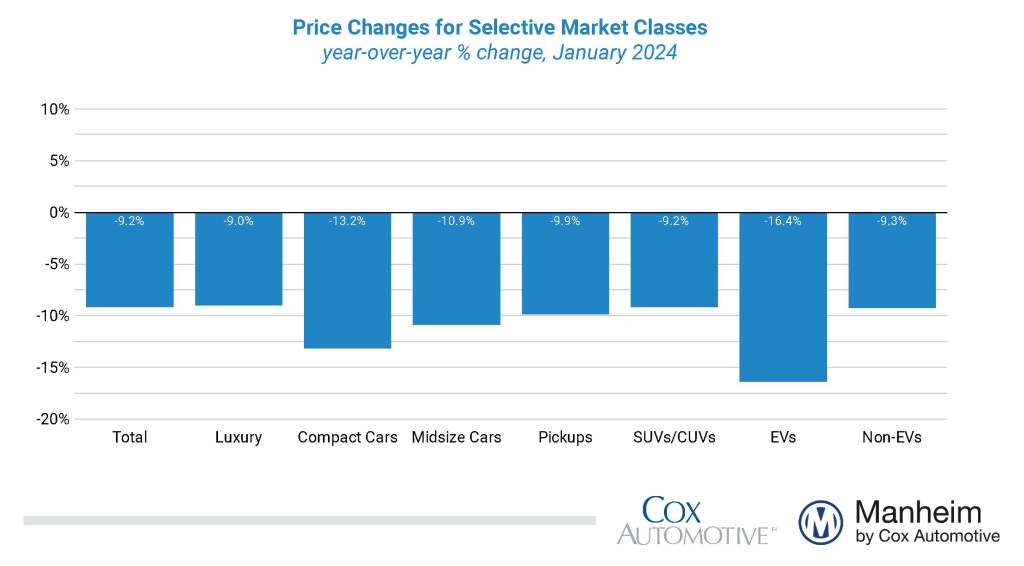

In major market segments, seasonally adjusted prices remained lower in January compared to the same month last year. Compared to January 2023, luxury goods' losses were lower than the industry, down 9.0%. Light-duty cars continued to be the worst performing year-over-year, with a 13.2% decline, followed by medium-duty cars with a 10.9% decline, and pickup trucks with a 9.9% decline. SUVs were flat with his 9.2% decline in the industry as a whole. Compared to the previous month, sales of luxury goods decreased by 0.8%, SUV sales decreased by 0.6%, and pickup sales decreased by 0.2%. Compensating for losses in other segments, small cars increased by his 0.4% and medium cars by his 0.1%.

Due to the growing interest in EV value and non-EV markets, we are sharing metrics for these segments for the first time this month. As a reference value, the seasonally adjusted EV value at the end of 2023 decreased by 16.9%, and non-EV vehicles decreased by 7.1% in the same year. Seasonally adjusted EV values in January were down 16.4% year-on-year, and non-EV vehicles were down 9.3% over the same period.

Used retail car sales increased in January

Assessing retail auto sales based on observed volume changes tracked by vAuto, it was initially estimated that used car retail sales would increase by 5% in January compared to December; used car retail sales were estimated to be down 3% year-on-year. The average retail price of used cars fell by 2.9% over the past four weeks.

An initial assessment using used retail inventory days estimates based on vAuto data shows that January supply ended at 53 days, five days less than the revised figure of 58 days at the end of December, but that January 2023 supply The amount increased by 4 days from 49 days. .

Total sales of new light vehicles in January increased by 2.8% compared to the same month last year, and there were one more sales day than in January 2023. On a unit basis, new car sales in January decreased by 26.2% from the previous month. January sales pace, or seasonally adjusted annual rate (SAAR), was 15 million units, down 0.7% from last year's 15.1 million units and 6.9% from December's revised pace of 16.1 million units.

Combined large rental, commercial and government fleet sales increased 3.1% in January compared to the same month last year. Sales to rental vehicles increased 20% year over year, while sales to commercial vehicles decreased 14% and sales to government vehicles increased 6.6%. Including estimates of fleet deliveries to dealer and manufacturer channels, residual retail sales are estimated to increase 4.1% over last year, resulting in an estimated retail SAAR of 12.3 million, down 100 million from last year's pace and 13.4 million in December. decreased from A million paces. Fleet market share is estimated at 16.8%, a decrease of 1% from last year's share.

Rental risk prices vary. Mileage decreased significantly in January

The average price of rental risk units sold at auction in December fell by 4.5% compared to the same month last year. Rental risk prices also fell by 3.3% compared to November. The average mileage of rental risk units in December (44,500 miles) was down 20.2% year over year and down 5.3% from November.

Most consumer confidence indicators improved in January

The Conference Board Consumer Confidence Index® rose 6.3% in January due to views on the current situation, rising 9.6% to its highest level since March 2020. Consumer confidence rose 8.3% year over year. Plans for car purchases over the next six months fell to the lowest level since April, and down from the same month last year. Consumer sentiment also improved in January, according to the University of Michigan's Sentiment Index. The Michigan index rose 13.3% for the month and was up 21.7% from the same month last year. Consumers' expectations for inflation in one year fell to 2.9%, which was the same as their expectations for inflation in five years. Consumers' views on car purchasing terms rose to their highest level since summer 2021 as negative views on prices and interest rates faded. Morning Consult's daily index of consumer sentiment was almost unchanged, dropping 0.6% in January, but rising 12.6% compared to the same month last year. Gasoline prices were raised in January. According to AAA, the national average price for unleaded as of Jan. 31 rose 1.3% to $3.15 per gallon, down 10% from a year earlier.

The complete suite of MUVVI monthly data for January will be released on the fifth business day of the month, March 7, 2024, as regularly scheduled.. The next quarterly MUVVI call will be held on April 5, 2024 at 11:00 a.m. Eastern Daylight Time.

For questions or data requests, please email manheim.data@coxautoinc.com. For the latest information on the Mannheim Used Car Value Index and a direct invitation to our quarterly calls, sign up for the Cox Automotive Newsletter. Mannheim Used Car Value Index Quarterly Call.

Note: of The Mannheim Used Car Value Index has been adjusted to improve accuracy and consistency across the dataset as of January 2023 data release. The MUVVI starting point was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, but in previous reports he had 1995 as the baseline of 100. All monthly and annual percentage changes since January 2015 are the same. Learn more about the decision to rebase indexes here.