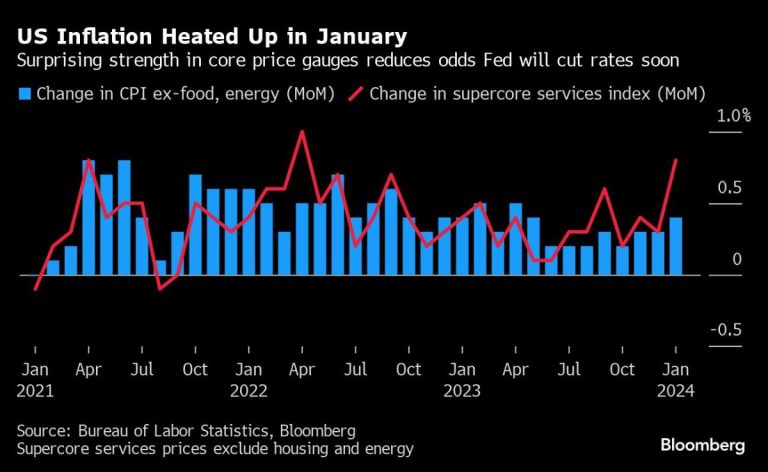

(Bloomberg) – U.S. stock futures fell after weaker-than-expected U.S. inflation data on Tuesday reinforced expectations that the Federal Reserve might not cut interest rates as quickly as expected. suggested recovery.

Most Read Articles on Bloomberg

S&P 500 contracts rose 0.5% after the index's worst day of inflation since September 2022. Benchmark U.S. Treasury yields regained some of the previous day's jump but remained near 4.3% as traders scaled back bets that the Fed would raise interest rates early. cut.

Coming soon: Sign up for the Hong Kong edition for an inside guide to the money and people rocking Asia's financial hub.

U.S. consumer price index (CPI) data had boosted investors' expectations that a rate cut was imminent, pushing U.S. stocks to record highs and pushing European peers to levels just shy of their record highs. It turned out to be a disappointment. Fed swaps changed its full rate cut from June to July as data and global bonds erased the last remnants of the bull market that began in December.

The setback did little to dissuade investors betting that the Fed would eventually turn accommodative. Russ Kesterich, a portfolio manager at BlackRock, said the setback is temporary and that U.S. stocks could rise another 6-8% this year, possibly leading to four more interest rate cuts. I'm looking at it.

“Despite yesterday's move in the stock market, this is probably going to be a decent year for U.S. stocks,” Kesterich said in an interview with Bloomberg TV. “There are reasons to hold stocks for the long term. I don't think the story has changed. We still think the Fed will start cutting rates later this spring or summer. We think it’s possible.”

There was good news on Wednesday for UK traders looking forward to policy easing from the Bank of England. UK inflation is lower than expected in January, and underlying price pressures have not risen as much as markets and the BoE had feared. The pound reversed its earlier gains and British government bonds rebounded in response to the data. The inflation data triggered a repricing of BOE interest rate bets, with traders resuming bets on three quarter-point cuts this year.

Oil prices firmed up after mixed U.S. inventory reports, but OPEC and the IEA offered contrasting outlooks for global oil markets. Gold is trading in a narrow range after falling below $2,000 an ounce for the first time in two months, while Bitcoin is trading around $50,000.

Listen to the Big Take podcast on iHeart, Apple Podcasts, Spotify, and Bloomberg Terminal. Read the transcript here.

Corporate highlights

-

Lyft Inc. rose in premarket trading Wednesday even as the ride-sharing company revised its 2024 profit outlook. The typo initially caused the stock to rise 67% in after-market trading on Tuesday.

-

ASML Holding NV said that the semiconductor market has reached its bottom and there are now signs of recovery.

-

Vizio fell in U.S. pre-market trading, giving up some of the previous day's 25% gain in the wake of a Wall Street Journal report that Walmart was in talks to buy the TV maker for more than $2 billion. Ta.

-

Shares in Heineken NV fell after the world's second-largest brewer warned that persistent inflation and economic concerns will weigh on beer demand in 2024.

-

ABN AMRO Bank NV has rebounded after announcing a new share buyback involving the Dutch state as part of a planned sale of the financial institution.

-

Robinhood shares soared in premarket trading after the online brokerage reported better-than-expected fourth-quarter net revenue.

-

Shares of home rental company Airbnb fell after the company reported fourth-quarter results.

This week's main events:

-

BOE Governor Andrew Bailey testifies before the House of Lords Economic Committee on Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Wednesday

-

Japan's GDP, industrial production, Thursday

-

US manufacturing industry, number of new unemployment insurance claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks on Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

Fed Director Christopher Waller speaks Thursday

-

ECB Chief Economist Philip Lane speaks on Thursday

-

U.S. Housing Starts, PPI, University of Michigan Consumer Sentiment, Friday

-

San Francisco Fed President Mary Daley speaks on Friday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Friday

-

ECB board member Isabel Schnabel speaks on Friday

The main movements in the market are:

stock

-

As of 8 a.m. New York time, S&P 500 futures were up 0.5%.

-

Nasdaq 100 futures rose 0.6%

-

Dow Jones Industrial Average futures rose 0.2%.

-

Stoxx European 600 rose 0.5%

-

MSCI World Index little changed

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0708.

-

The British pound fell 0.3% to $1.2558.

-

The Japanese yen rose 0.1% to 150.60 yen to the dollar.

cryptocurrency

-

Bitcoin rose 4% to $51,563.08

-

Ether rises 4% to $2,739.28

bond

-

The 10-year Treasury yield fell 1 basis point to 4.30%.

-

Germany's 10-year bond yield fell 2 basis points to 2.37%.

-

UK 10-year bond yields fell 7 basis points to 4.08%.

merchandise

-

West Texas Intermediate crude rose 0.1% to $77.98 per barrel.

-

Spot gold fell 0.1% to $1,990.29 an ounce.

This article was produced in partnership with Bloomberg Automation.

–With assistance from Winnie Hsu and Garfield Reynolds.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP