SimonSkafar/E+ via Getty Images

Generally, experiencing an increase in revenue is positive for a company. However, increased revenue does not necessarily continue. And at the end of the day, a company's profits and cash flow determine its profits. A good example of the disconnect between growth and profitability can be seen in automotive retail companies. sonic automotive (New York Stock Exchange:SAH). In October 2022 I wrote something bullish article About the company because the stock price was low. Some of the company's financial results were far from ideal. However, it was acceptable given how affordable the units were at the time. After rating the company a “buy”, the stock achieved a 25.9% gain for shareholders. In other words, for a little over a year, An amazing amount of gratitude. That said, his 35% increase over the same period did not match the S&P 500's.

I believe this issue has nothing to do with growth. And it's true that the stock is very attractively priced at the moment. In fact, they are among the lowest in this market. That being said, earnings and cash flow have been in retreat since the end of 2022. The good news is that management is working to rectify these issues. And if it does, the end result could be very positive for investors. At this point, we've decided to keep the business only a Buy rating as we haven't seen any meaningful progress on this yet. However, given how cheap the stock is, I could become even more bullish if bottom-line results start to improve significantly.

The picture has changed

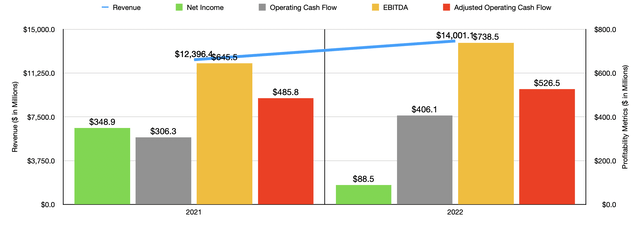

If you were to evaluate Sonic Automotive's investment value based solely on its annual results, you'd be confused as to why the company doesn't measure up to the broader market. In 2022, his sales were quite high at $14 billion. This is 12.9% more than the $12.4 billion generated in 2021. In terms of new cars sold by the company, sales decreased slightly from 103,486 to 103,283. However, revenue per new unit sold increased approximately 12% from $49,456 to $55,402. If you follow the auto retail industry closely, this shouldn't come as a surprise. Overall sales were down compared to the previous year, at least for the US market. The auto strike, coupled with supply chain issues, primarily related to microprocessors, caused sales to decline and prices to rise.

Author – SEC EDGAR Data

The second-hand retail sector saw a significant decline of around 6% in terms of sales. The number of deaths decreased from 183,292 to 173,209. But that didn't stop revenue per unit from increasing. It rose about 20% from $26,609 to $31,842. As a result, wholesale vehicle sales decreased by 4% from 36,795 units to 35,323 units. In this case, the revenue per unit increased by about 38% from $9,980 to $13,727. The company's profit decreased from $348.9 million to $88.5 million, primarily due to three of his $120.4 million impairment charges. However, as the chart above shows, all other profitability metrics for the company improved from 2021 to 2022.

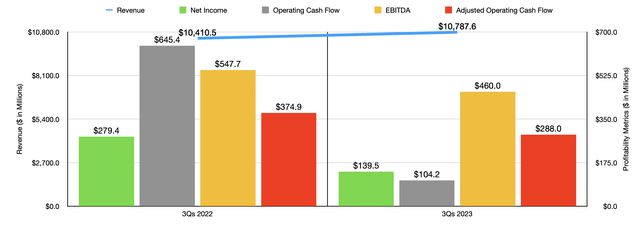

Author – SEC EDGAR Data

The situation began to change in 2023. Revenue continued to increase year-over-year, from $10.41 billion in the first nine months of 2022 to $10.79 billion in the first nine months of last year. In fact, new unit sales increased during this period, and revenue per new unit increased slightly. However, the cost of procuring these vehicles further increased significantly, and gross profit per new vehicle decreased by approximately 26%. Regarding used cars, the company reported a 4% increase in sales volume. In this case, revenue per unit decreased by approximately 8%. And, combined with higher procurement costs, gross margin per unit decreased by approximately 25%. As a result of these factors, net income plummeted from $279.4 million to $139.5 million. If that's all you have, you'll understand. But as the chart above shows, all three of his cash flow metrics I looked at also worsened year over year.

Last year, management acknowledged that some of the company's problems were related to its Echo Park division, which primarily focuses on selling used cars. In June 2023, the company indefinitely suspended operations at eight of these locations and 14 associated distribution and purchasing centers. This was followed by the closure of several other assets later this year. Management has also worked hard to reduce the total number of days of supply for this division from 30 days to 40 days. He is now down to 37 days, compared to 57 days at the same time a year ago. The problem with this unit, in my opinion, is that profit margins are already tight when you're dealing with lower priced vehicles. Management is marketing this segment as a place where consumers can get used cars for up to $3,000 below market value. For comparison, in fiscal 2022, combined used car sales and wholesale sales accounted for 43% of the company's revenue, but only 8% of its gross profit. This is a fundamentally different strategy from luxury brands, which account for about 52% of the company's revenue, and imported brands, which account for 18%.

In 2023, the situation was even worse. Indeed, the company's largest segment, the Franchise Dealer Division, saw weaker revenue year over year, with segment profit dropping from $472.2 million to $357.2 million. However, it was undoubtedly the company's used car division, Echo Park, that was in the red. The company incurred a segment loss of $100 million in the first nine months of 2022, followed by a $116.5 million loss in the same period in 2023. Even as management continues to cut costs and focus on growing sales related to franchised dealers, which are part of the business, the company faces challenges through the first quarter of fiscal 2024. The plan is to reach the EBITDA break-even point for the Echo Park division. If it can achieve that, the upside potential could be quite meaningful given how management sees a market opportunity to address, which equates to approximately 2 million vehicle sales per year. There is.

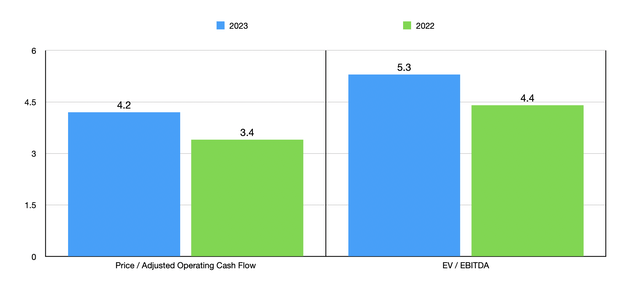

Author – SEC EDGAR Data

We don't really know what to expect in the final quarter of 2023. However, if we annualize the results for the first nine months of this year, we would expect adjusted operating cash flow to be $435.8 million and EBITDA to be his $620.2 million. Using the results, I was able to evaluate the company as described above. The 2023 data shows the stock is more expensive than if we used the 2022 data. But in either case, the stock price looks pretty attractive. We then compared the company to five similar companies in the table below. In terms of the pricing approach to operating cash flow, Sonic Automotive became the cheapest company in the group. And when considering the EV to EBITDA approach, it tied for the cheapest.

| company | Price/operating cash flow | EV/EBITDA |

| sonic automotive | 4.2 | 5.3 |

| Group 1 Automotive (GPI) | 9.5 | 6.6 |

| Asbury Automotive Group (ABG) | 16.7 | 5.3 |

| Lias Motors (LAD) | 24.4 | 8.5 |

| Autonation (AN) | 6.8 | 6.7 |

| Penske Automotive Group (PAG) | 8.0 | 7.7 |

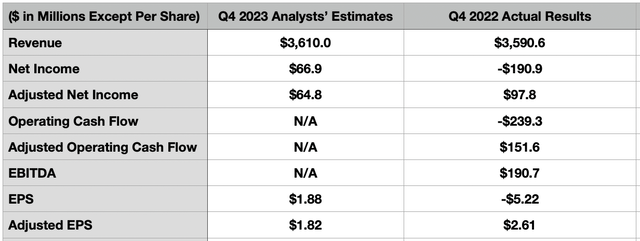

Please note that images are subject to change at any time. The next opportunity for such change is just around the corner. Before the market opens on February 14, the company's management is expected to announce financial results covering the final quarter of fiscal 2023. Analysts expect sales to be $3.61 billion. However, this will be only slightly higher than the $3.59 billion reported a year ago. Earnings per share are expected to be $1.88, or profit of $66.9 million. This compares to the loss of $5.22 per share reported a year ago. However, adjusted earnings are expected to decline from $2.61 to $1.82 per share. That would reduce adjusted profit from $97.8 million to $64.8 million. Neither management nor analysts provided forecasts for other profitability metrics. But in the table below you can see what some of these were in his final quarter of 2022. Perhaps the final quarter of 2023 could be a bit worse.

author

remove

There's no denying that Sonic Automotive is facing some issues from a profitability perspective at the moment. That's quite unfortunate. But the long-term outlook will almost certainly be positive. As the population increases, car sales should also increase over time. Despite the weakness, cash flow remains attractive and the stock is among the cheapest in its industry. Management is also taking advantage of this opportunity. The company allocated $90.7 million for share buybacks in the first quarter of 2023. There were no buybacks in the second quarter, but in the third quarter he made $86.8 million worth of buybacks. Still, the company still has $286.8 million worth of capacity remaining under its existing share buyback program. In fact, the company has repurchased approximately 21% of its outstanding units since 2019. I'm not a big fan of stock buybacks myself, but I love seeing them when stock prices are this low.

All things considered, this data suggests to me that Sonic Automotive is a good prospect for value-oriented investors. Therefore, I will maintain my “buy” rating for now without any issues.