The UK's one millionth battery electric vehicle (BEV) will hit the road in January 2024, with the new car market growing by 8.2% in the same month, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The UK's one millionth battery electric vehicle (BEV) will hit the road in January 2024, with the new car market growing by 8.2% in the same month, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

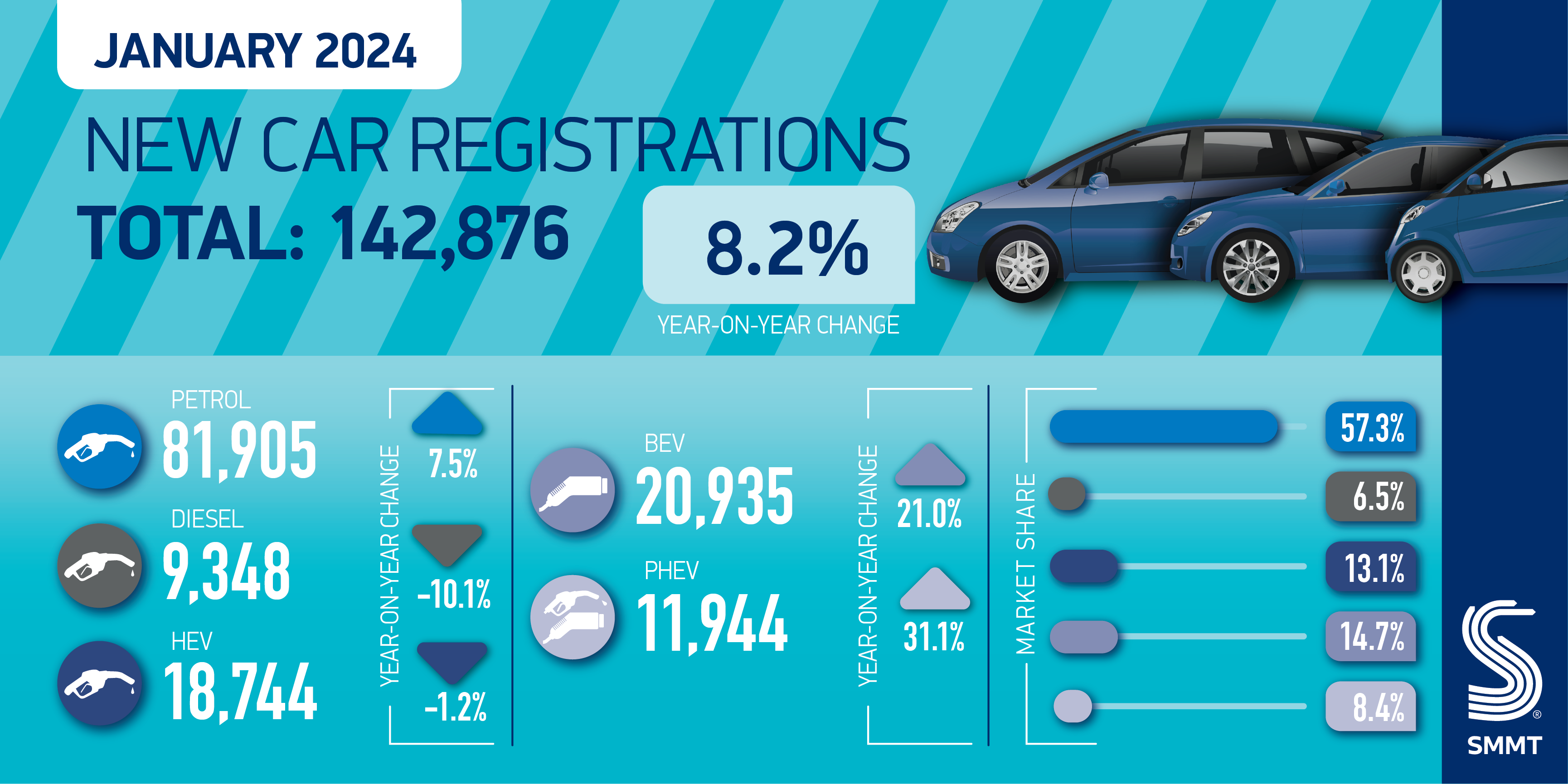

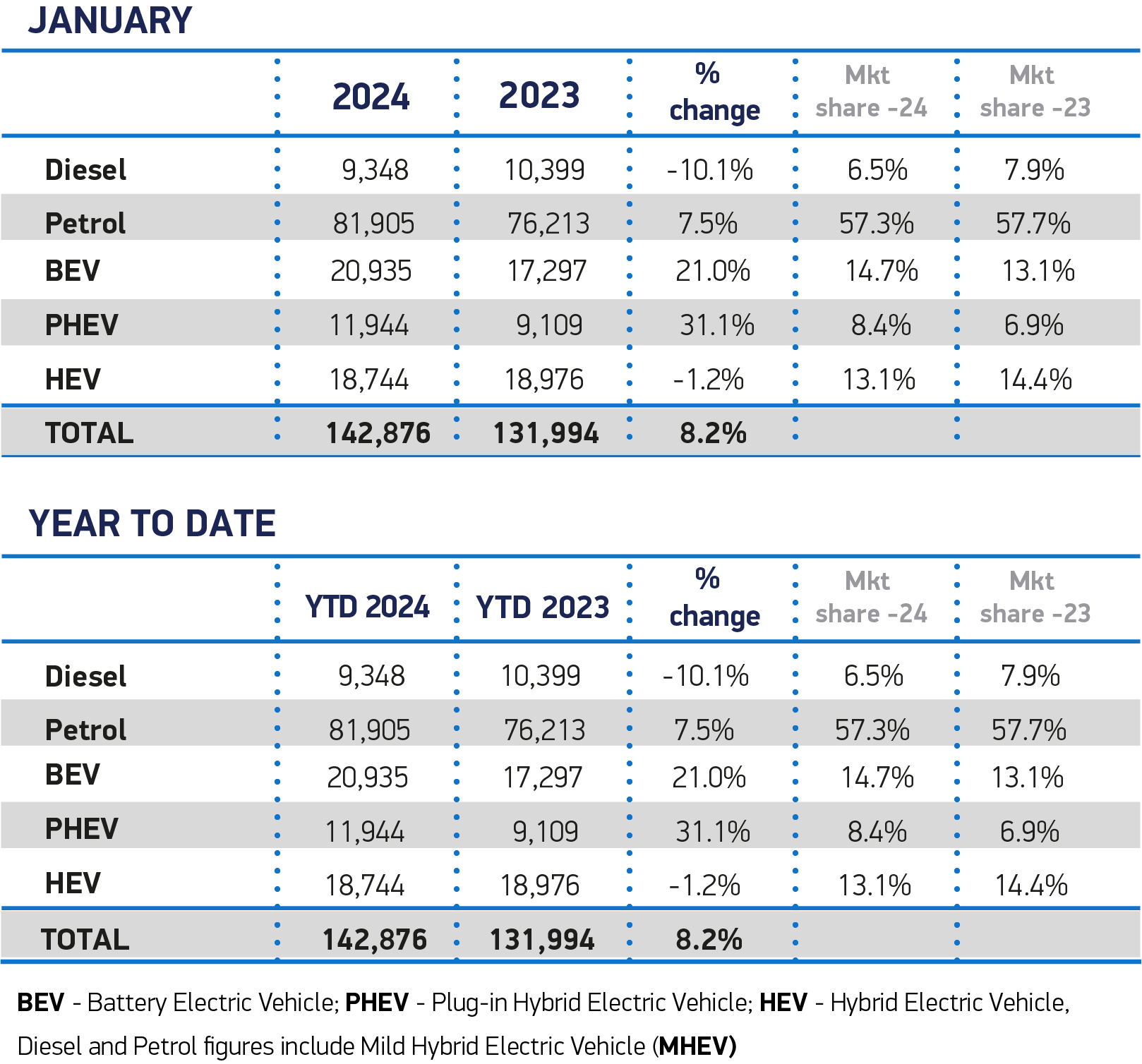

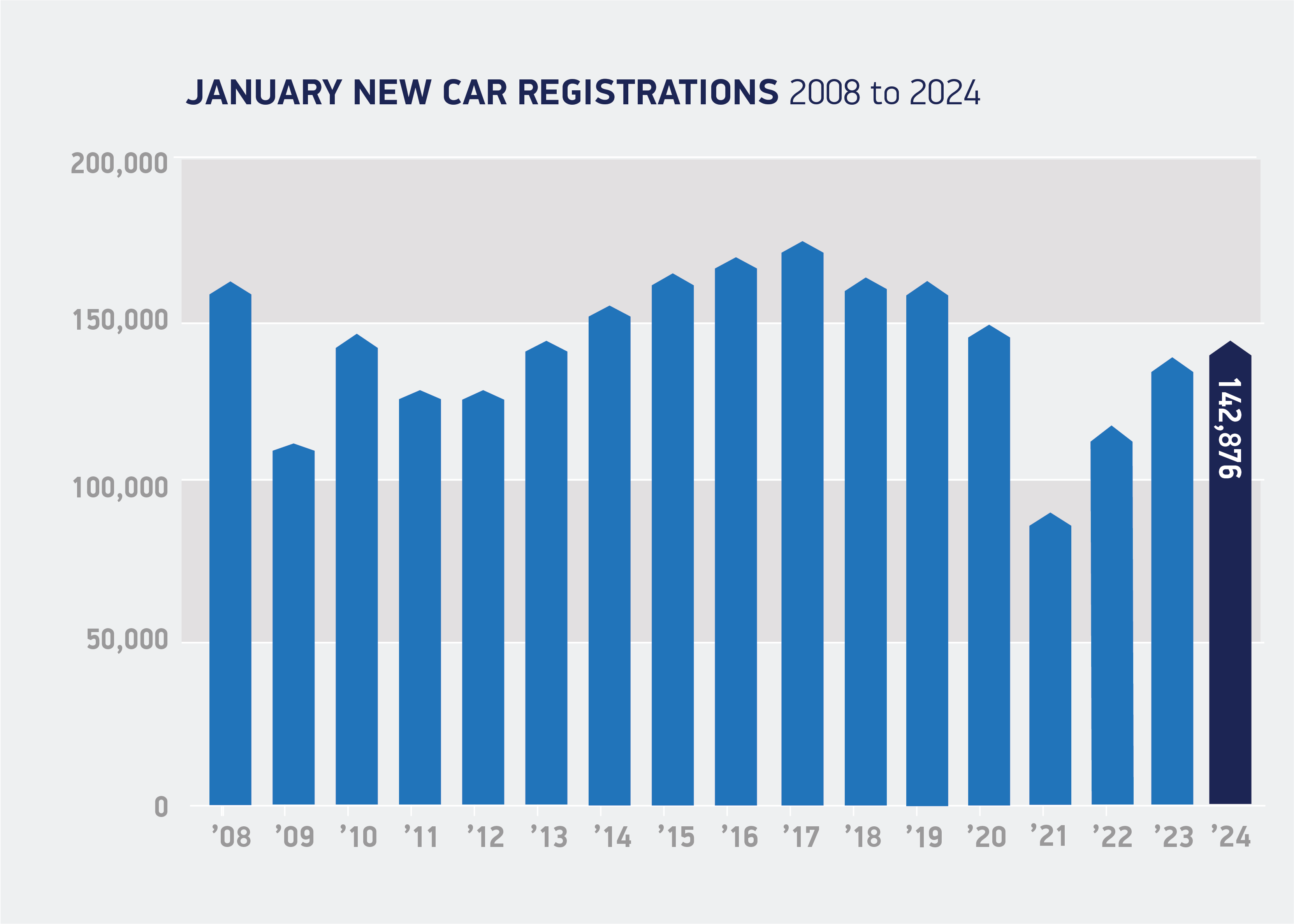

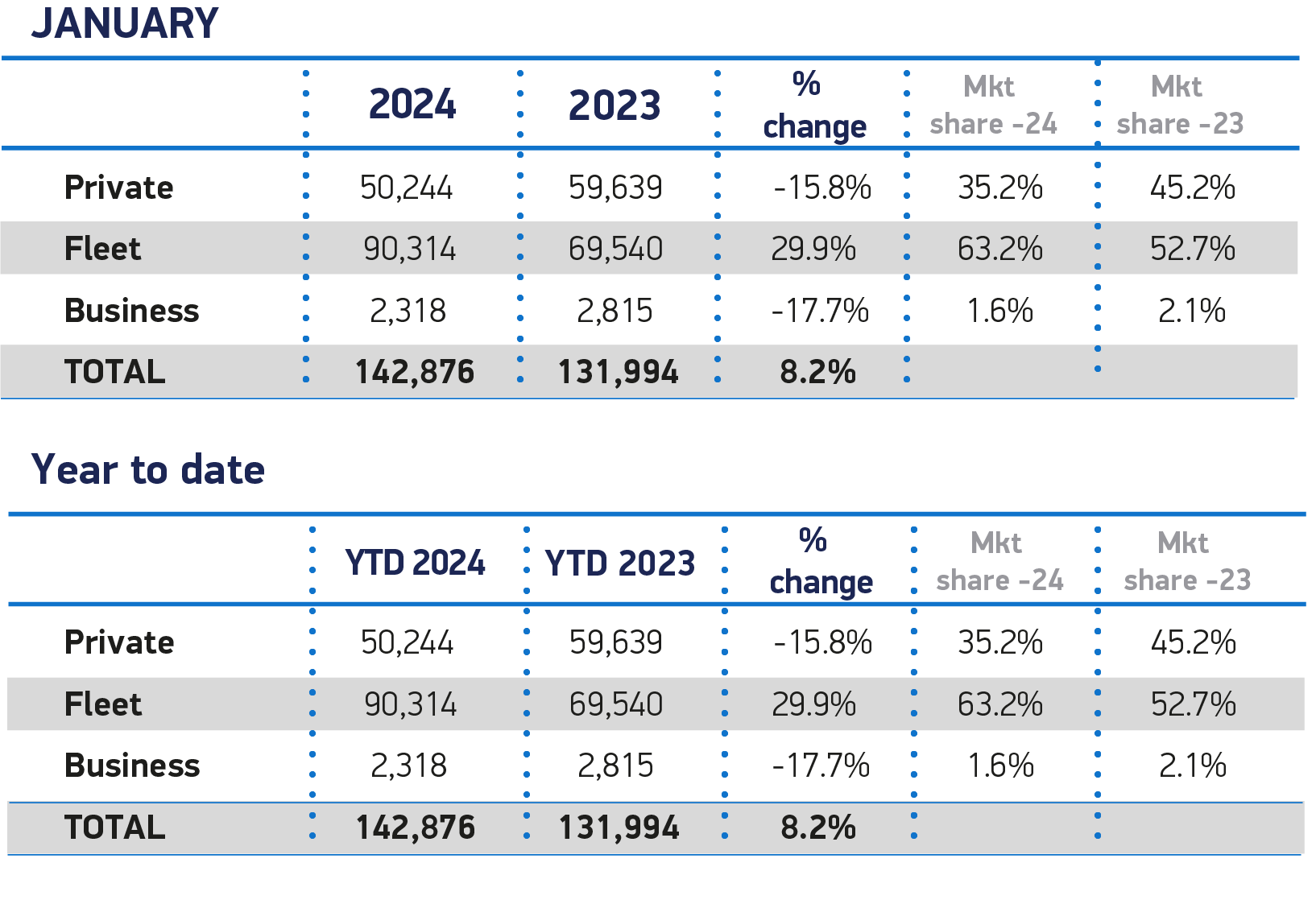

In the first month of this year, 142,876 new cars were registered, an increase of 10,882 in January 2023, the best monthly performance since 2020, and the 18th consecutive month of increase. This increase was solely due to the fleet market, which increased by 29.9%, while personal retail usage decreased by -15.8%. More than 6 out of 10 new vehicles registered (63.2%) were owned vehicles, an increase from just over half (52.7%) last year.

The market also barely reached the milestone of 1 million BEV registrations that had been expected since records began. Approximately 20,935 BEVs were registered in January, an increase of 21.0% from the previous year, bringing the total since 2002 to 1,001,677. This is a testament to the manufacturer's commitment to offering a growing number of zero-emission models.1 BEV market share also increased to 14.7% year-on-year in January, which is lower than the 16.5% achieved for all of 2023. Plug-in hybrids (PHEVs) recorded a sales increase of 31.1% and accounted for 8.4% of the market. Meanwhile, hybrid (HEV) sales decreased by -1.2%, with a share of 13.1%.

Fluctuations in BEV supply are expected as manufacturers adjust product allocation following last-minute resolutions on UK and EU rules of origin, which had previously threatened to impose tariffs on EVs to limit affordability. , is likely to continue in the future. However, while vehicle and business demand for BEVs increased by 41.7% in January, registrations by private buyers fell by -25.1%. This trend continues and will undermine the UK's ability to achieve net zero.2

The UK is currently the only major market that combines a 2035 end-of-sales date with a mandated zero-emissions vehicle market share, but there are no significant incentives for consumers. However, it is becoming increasingly clear that private buyers need more support to make the switch. Ahead of next month's Budget, industry is calling on the government to support consumers by temporarily halving the value added tax on new BEV purchases. These measures will cost the Treasury an average of just £1,125 per car, which is less than the cost of the previous plug-in car grant, and will help bring in more than 250,000 electric cars rather than petrol or diesel. I will do it. In addition to what was already expected, it will be realized by the end of 2026. This not only allows him to reduce his CO2 by more than 5 million tons during that time, but also3that means the next million EVs could be shipped within just two years.

Temporarily lowering the value-added tax on EVs will partially mirror the tax exemptions already offered to consumers for other carbon-reducing technologies, such as heat pumps. Supporting today's EV consumers will also lead to broader benefits such as increasing the supply of used EVs, widening the overall market to make it more attractive for charging and manufacturing investment, and reducing the UK's carbon footprint. You will also be able to secure profits.

Mike Hawes, CEO of SMMT, said:

It took more than 20 years to reach the 1 million EV milestone, but with the right policies, we can double that success in just two more years. Currently, market growth is dependent on companies and vehicles. The government therefore needs to use its next budget to support private EV buyers, cut carbon, boost economic growth and temporarily halve VAT so everyone can switch to electric cars. . Manufacturers are being asked to supply vehicles, but we are now calling on governments to help consumers buy vehicles that rely on net zero.

The latest outlook for the new car market in 2024 predicts total sales of 1,974,000 units, an increase of 4,000 units from October's estimate, but BEV's forecast shows that the market share for the year will be It was lowered to 21.0%. The October forecast was 22.3%, and the previous year's forecast was 23.3%. There will be 100,000 more BEVs on the roads in 2024 compared to last year, although myriad factors such as high energy prices, inflation and interest rates, charging concerns, and mixed messages from governments are limiting demand. This is expected to reach a total of approximately 414,000 units, or more than 1 in 5 units. new car. This amount will increase further if a VAT reduction for EVs is introduced.

sauce: SMMT