-

increase in revenue: Fourth-quarter sales increased 5% to $3.83 billion, and full-year sales rose 10% to $15.81 billion.

-

Net income: Fourth-quarter net income increased 5% to $553 million, and full-year net income increased 8% to $2.35 billion.

-

Earnings per share: Diluted earnings per share increased 11% to $9.26 in the fourth quarter and increased 15% to $38.47 for the full year.

-

Existing store sales: Increased 3.4% in the fourth quarter, contributing to a 7.9% increase in the full year.

-

expansion: 186 new stores opened in 2023, including the entry into Puerto Rico and a new distribution center in Mexico.

-

Acquisition of treasury stock: ORLY invested $3.15 billion and repurchased 3.6 million shares in 2023.

-

Guidance for 2024: Same-store sales are expected to increase 3.0% to 5.0%, with total revenue of $16.8 billion to $17.1 billion.

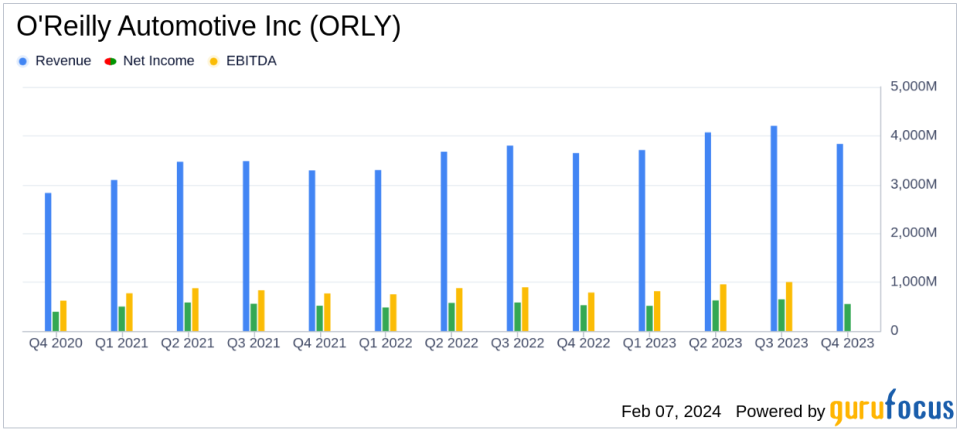

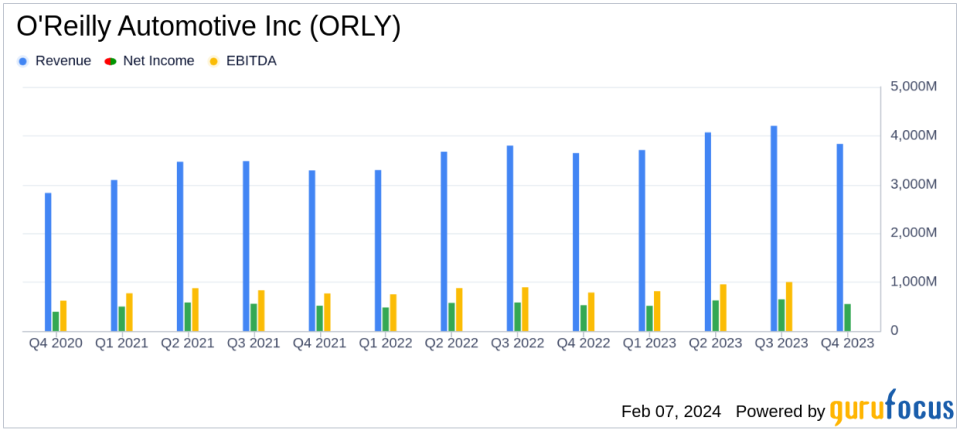

O'Reilly Automotive, Inc. (NASDAQ:ORLY) released its 8-K filing on February 7, 2024, announcing record sales and profits for the fourth quarter and full year of 2023. This marks the 31st consecutive year of U.S. same-store sales growth. O'Reilly Automotive, a leading retailer in the automotive aftermarket industry, operates his 6,157 stores in 48 U.S. states, Puerto Rico and Mexico, serving both professional service providers and do-it-yourself customers.

Fourth Quarter and Full Year Financial Highlights

O'Reilly reported fourth-quarter sales of $3.83 billion, up 5%, and gross profit of $1.97 billion (51.3% of sales), up 6%. Operating income increased 5% to $719 million, representing 18.8% of sales. Net income for the quarter was $553 million, an increase of 5%, and diluted earnings per share increased 11% to $9.26.

Full-year results were equally impressive, with revenue up 10% to $15.81 billion. Gross profit for the year increased 10% to $8.1 billion, or 51.3% of sales. Operating income increased 8% to $3.19 billion (20.2% of sales). Net income for the period increased 8% to $2.35 billion, and diluted earnings per share increased 15% to $38.47.

Strategic growth and stock repurchase program

CEO Brad Beckham highlighted the company's expansion efforts, including opening 186 new stores and establishing a new distribution center in Guadalajara, Mexico. The company's stock repurchase program remains active, with the company repurchasing 3.6 million shares in 2023 at an average price of $883.13 per share, for a total of $3.15 billion.

“Our success in 2023 is a testament to Teams’ hard work, and as we look to 2024, we continue to consistently execute on our dual market strategy and build on Teams’ ability to deliver industry-best customer service. I have absolute confidence,” Beckham said. .

O'Reilly's 2024 guidance includes net new store openings of 190 to 200 stores and expected total sales of $16.8 billion to $17.1 billion. The gross profit margin is expected to be 51.0% to 51.5%, and the operating profit margin is expected to be 19.7% to 20.2%. The effective income tax rate is expected to be 22.6%, and his diluted earnings per share are expected to be between $41.05 and $41.55.

Financial statements and leadership changes

Looking at the balance sheet, total assets have steadily increased to $13.87 billion from $12.63 billion the previous year. The company also completed its leadership succession plan with the retirement of CEO Greg Johnson, the promotion of Brad Beckham to CEO, and the promotion of Brent Kirby to president. Greg Johnson will be appointed to the O'Reilly Board of Directors, subject to shareholder approval.

O'Reilly Automotive, Inc. (NASDAQ:ORLY) continues to demonstrate strong financial health and strategic growth, positioning it for continued success in the highly competitive automotive aftermarket industry. With a strong foundation and a clear vision for the future, O'Reilly plans to maintain its trajectory of profitable growth and market share expansion.

For more information, see O'Reilly Automotive Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.