-

net sales: Increased 12% to $47.5 million in the second quarter.

-

Net income: Soared 221% to $12.6 million in the second quarter.

-

Adjusted EBITDA: Increased 191% to $15.1 million in the second quarter.

-

recurring service income: Increased 25% to $18.5 million in the second quarter, with gross margin of 90%.

-

dividend: A quarterly dividend of $0.10 per share was declared, an increase of 25% from the previous dividend.

-

Balance sheet: Total cash, investments and securities strengthened by 18% to $79 million.

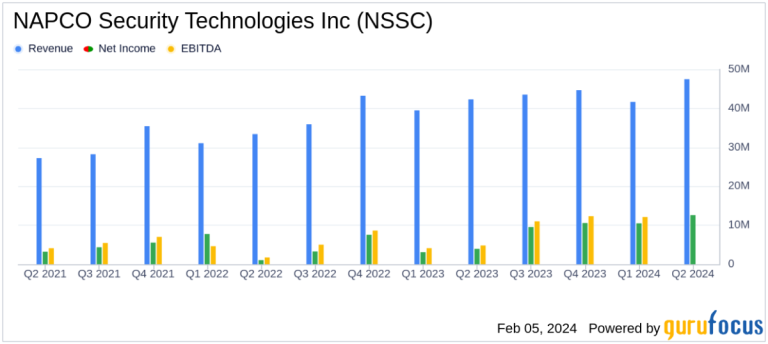

On February 5, 2024, NAPCO Security Technologies Inc (NASDAQ:NSSC) released its 8-K filing, announcing a record second quarter for fiscal 2024. The company is a prominent manufacturer of security products such as access control systems and door security products. Locking products, intrusion and fire alarm systems, and video surveillance products have posted record sales for 13 consecutive quarters.

NAPCO's results this quarter are particularly important as they reflect the company's ability to sustain growth in a highly competitive industry. The 12% year-over-year increase in net sales to his $47.5 million is a testament to the company's strong product offering and market presence. A 221% increase in net income to $12.6 million and a 191% increase in adjusted EBITDA to $15.1 million demonstrate the success of NAPCO's operational efficiency and profitability maximization strategy.

The company is focused on recurring services revenue, which grew 25% to $18.5 million and delivered an impressive gross margin of 90%. This highlights the strategic importance of building a stable and predictable revenue stream. This growth indicates the company's potential for sustainable long-term returns, an important factor for value investors.

Financial performance and challenges

Although record financial results are noteworthy, challenges remain, such as the dynamic nature of technology and the need for continuous innovation in the security industry. The introduction of Prima, NAPCO's new all-in-one panel, demonstrates the company's commitment to innovation and strategy to capture greater market share.

Despite the positive trends, the company recognizes the need to further improve its hardware gross margin, which currently stands at 29%. Management's focus on improving this metric could further improve profitability in the future.

NAPCO is well-positioned for future investments and shareholder returns with a strong balance sheet of $79 million in cash and cash equivalents, other investments and securities and no debt. The increase in net cash provided by operating activities to his $18.7 million further highlights the company's financial health.

Income statement and balance sheet highlights

The main details of the income statement and balance sheet are:

|

financial indicators |

2nd quarter of 2024 |

2nd quarter of 2023 |

|---|---|---|

|

net sales |

$47.5 million |

$42.3 million |

|

Net income |

$12.6 million |

$3.9 million |

|

Adjusted EBITDA |

$15.1 million |

$5.2 million |

|

cash and cash equivalents |

$79 million |

$66.7 million |

These metrics are extremely important as they provide insight into a company's revenue growth, profitability, and liquidity, all of which are important considerations for value investors.

Richard Soloway, Chairman and President of NAPCO, said: “The second quarter of 2024 was the strongest quarter in our company's history.” “Net income of $12.6 million and adjusted EBITDA of $15.1 million were also record-breaking for the quarter.”

Analysis and outlook

The impressive growth in net income and adjusted EBITDA reflects NAPCO's ability to effectively manage its business and exploit market opportunities. The company's strategy of focusing on recurring service revenue has been successful, providing a stable, high-margin revenue base to complement hardware sales.

The company's announcement of a quarterly dividend of $0.08 to $0.10 per share demonstrates confidence in its financial position and commitment to returning value to shareholders. The move is likely to be well-received by the investment community, especially those focused on income-producing stocks.

NAPCO continues to navigate the competitive landscape of the security technology industry, and its strong financial results, innovative product offerings, and strong balance sheet suggest a positive outlook for the company's future performance.

For more information on NAPCO Security Technologies Inc.'s financial results, please visit the Investor Relations section of the company's website or participate in the conference call with details included in the earnings release.

For more information, see NAPCO Security Technologies Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.