Summary of recent transactions

December 29, 2023 Renaissance Technologies, led by Jim Simmons (Trades, Portfolios), has made a notable adjustment to its investment portfolio by reducing its stake in Kearney Financial Corporation (NASDAQ:KRNY). . The company sold 179,630 shares at a trading price of $8.97, changing the number of shares held by -5.18%. After this transaction, the company's total number of shares in KRNY will be 3,286,513 shares, representing a 0.05% position in the portfolio and 5.10% ownership in the listed company.

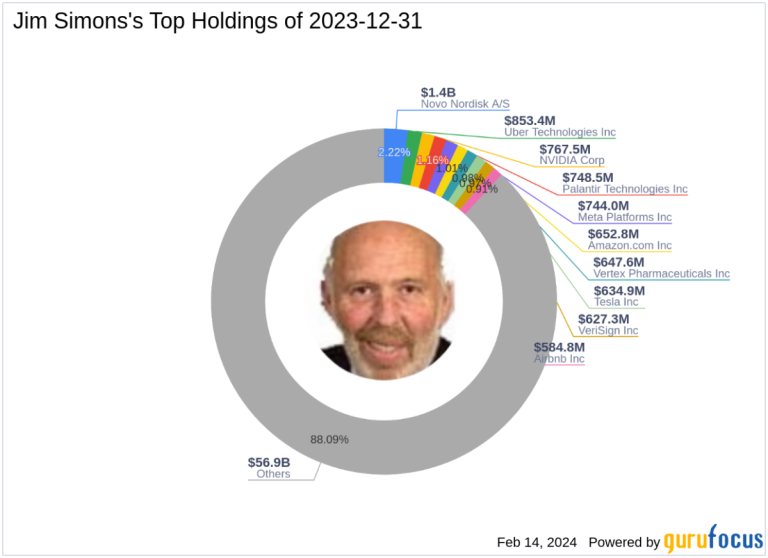

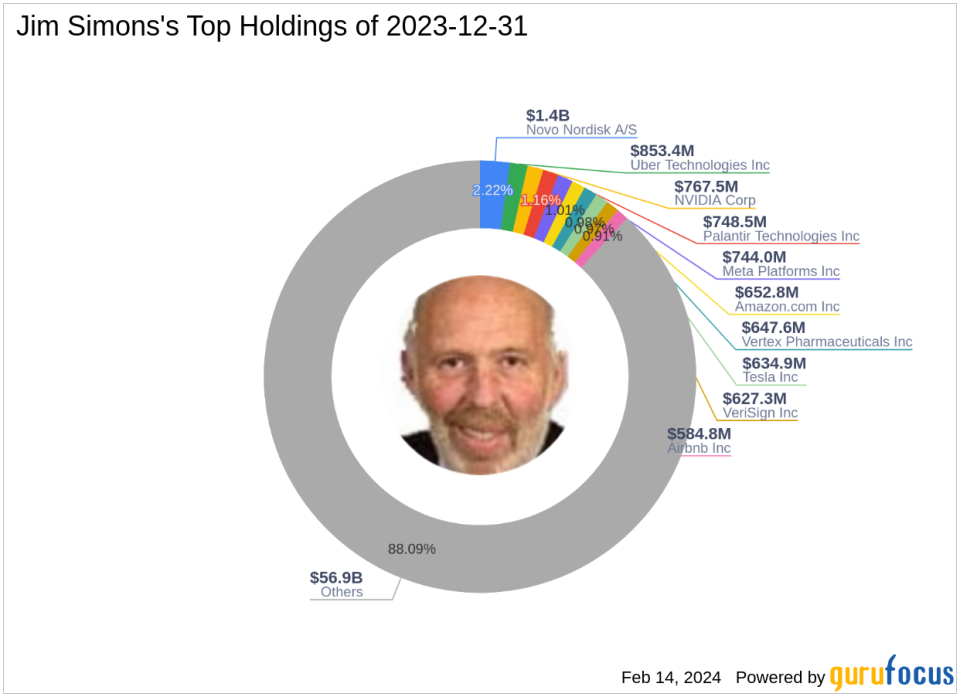

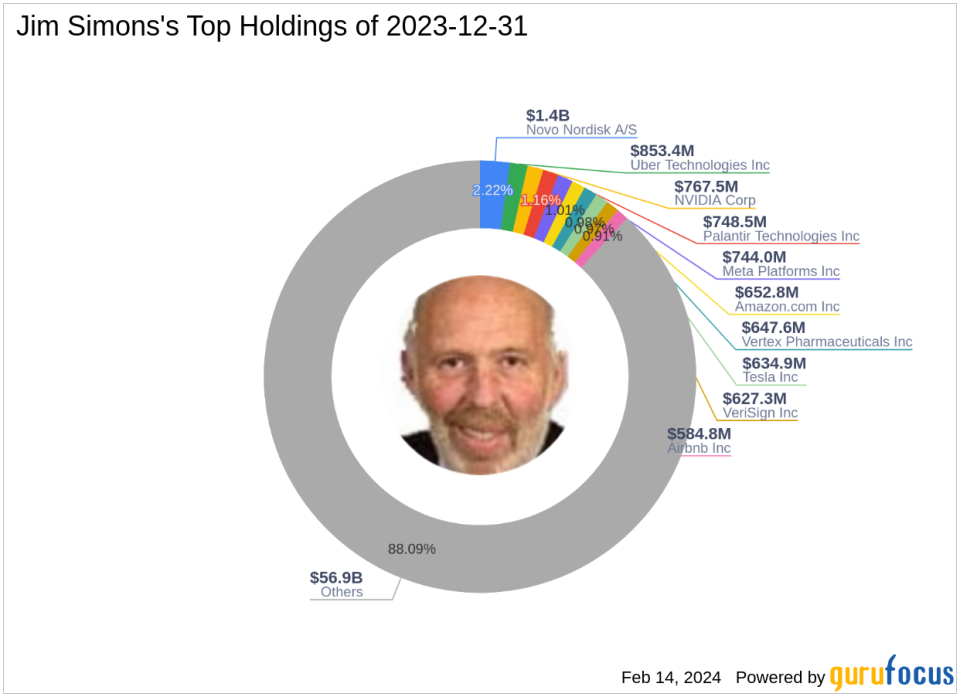

Jim Simons (Trade, Portfolio) and Renaissance Technologies

Renowned mathematician and quantitative investor Jim Simmons (Trading, Portfolios) founded Renaissance Technologies in 1982. Since then, the company has become one of the most successful hedge funds in the world and is known for its sophisticated mathematical models and automated trading strategies. Renaissance Technologies focuses on identifying non-random price movements through extensive data analysis to predict market changes. The firm's investment philosophy emphasizes scientific thinking and skepticism of statistical flukes, which contributes to the firm's impressive track record.

Overview of Kearney Financial Corporation

Kearny Financial Corp., founded in 2005, is a savings bank with operations primarily in New Jersey and New York. The bank's business model revolves around collecting public deposits and using the funds to originate and purchase loans and invest in securities. With a focus on real estate loans and a combination of business and consumer loans, Kearney Financial Corp.'s primary source of revenue is net interest income. The company's market capitalization is $411,108,000, and the current stock price of $6.38 reflects a significant undervaluation according to GuruFocus' GF Valuation.

Portfolio impact of trade

Renaissance Technologies' recent sale of KRNY stock has minimal impact on the overall portfolio composition of Jim Simmons (Trades, Portfolios). With a position size of 0.05%, this transaction will not significantly change the company's investment strategy. However, Kearney Financial Corporation's 5.10% ownership indicates significant interest in the bank's future performance and strategic direction.

Kearny Financial Corp Market Rating and Performance

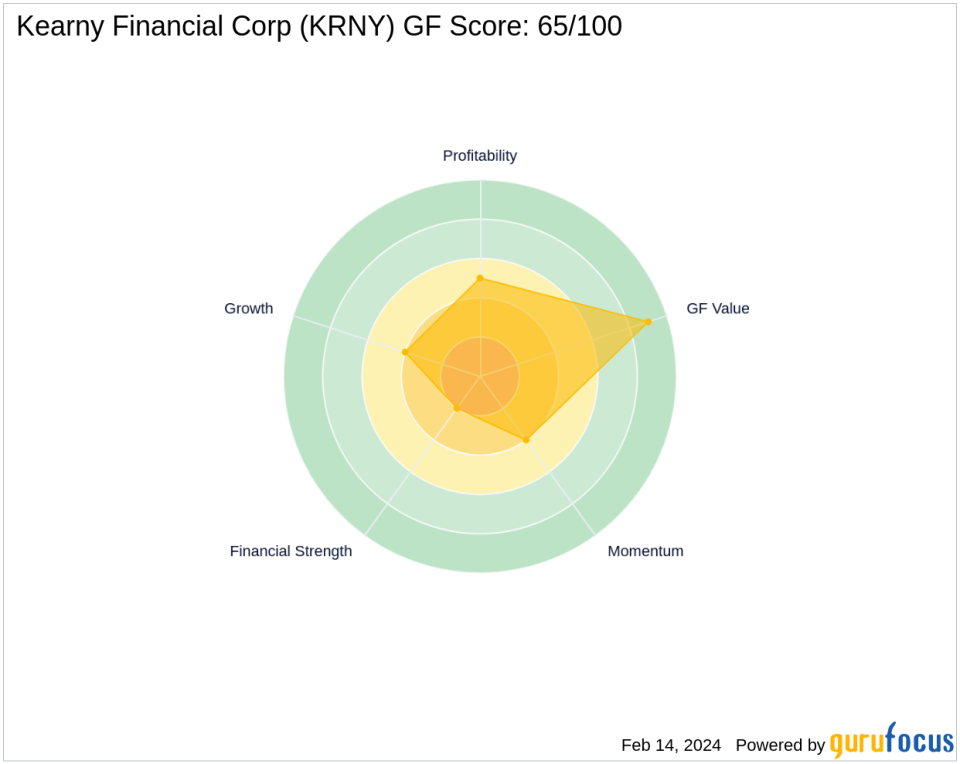

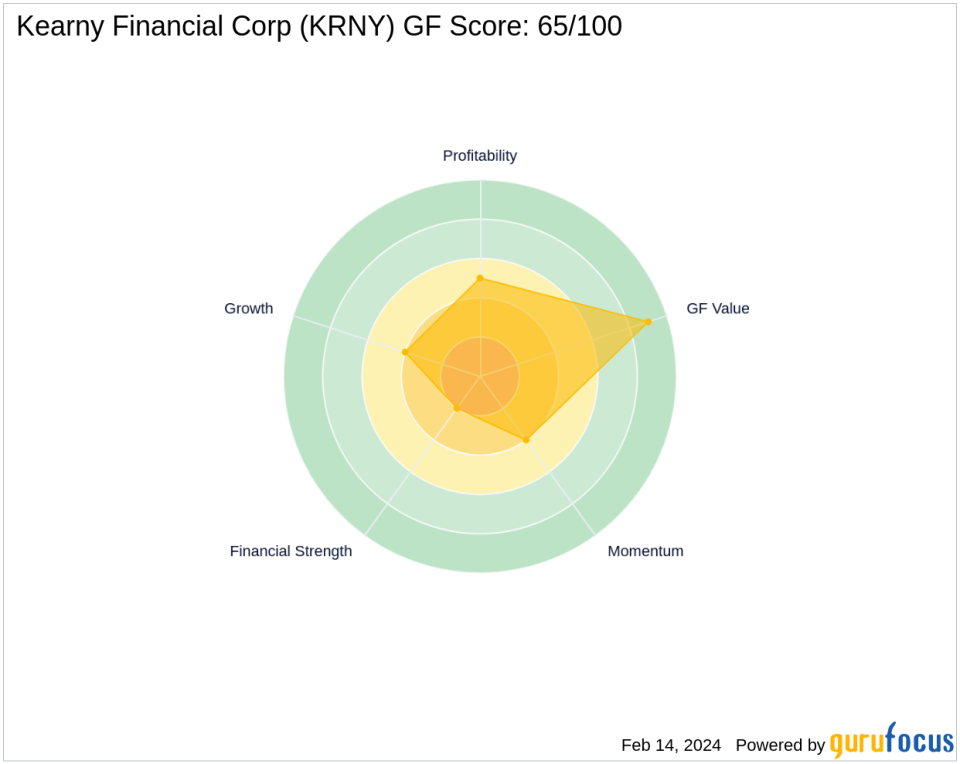

Kearney Financial Corporation's current P/E ratio is 22.00, representing 69% of its GF value, suggesting the stock is significantly undervalued. The company's performance metrics, including a GF score of 65/100, indicate a moderate chance of future performance. Despite the recent price drop of 28.87% since this transaction, the company's intrinsic value and growth prospects remain attractive.

Industry and sector comparison

When compared to the broader banking industry, Kearney Financial Corporation's performance is closely monitored by investors. The stock's valuation and growth outlook are particularly important given that Jim Simmons (Trades, Portfolio)'s major holdings are concentrated in the technology and healthcare sectors, which typically exhibit different market dynamics.

Market reaction and future outlook

The market's reaction to Renaissance Technologies' KRNY stock cut has been reflected in subsequent price action. Year-to-date stock price volatility is -28.56%, with investors keenly watching for a potential rebound in the stock based on GuruFocus' proprietary rankings and scores.

Comparison with largest shareholder

Hotchkis & Wiley Capital Management LLC currently holds the title of Kearney Financial Corporation's majority shareholder. Comparing the position of Jim His Simmons (Trades, Portfolio) with that of its largest shareholder provides insight into the company's stock's appeal among value investors. Strategic bets by key market players.

Transaction analysis and impact

Jim Simmons' (Trade, Portfolio) firm's downgrade of Kearney Financial Corporation's stock is a strategic move in line with the firm's data-driven investing approach. Although the impact of this transaction on the stock price is not yet fully understood, the company's continued interest in KRNY is based on the bank's financial health and market performance, as indicated by the remaining shares. suggests a calculated decision. Investors will be watching closely to see how this adjustment plays out within Renaissance Technologies' broader portfolio strategy.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.