European energy security is being used as an excuse to build more LNG terminals in the US than is actually neededclaim that Ana Maria Jarrah Makarewicz at IEEFA. European gas demand is expected to continue to decline. Even for U.S. projects currently under construction. LNG export capacity in 2030 will exceed Europe's forecast demand by 76%. Jarrah Makarewicz says the United States should seriously reevaluate its strategy or risk overinvestment.she presents Data and forecasts on European demand, imports and US export capacity. These projections need to be added to the United States' current thinking on LNG. In January, President Biden suspended approvals for LNG exports.citing the impact on the environment and domestic economy.

European energy security is being used as an excuse to build more LNG terminals in the US than is actually neededclaim that Ana Maria Jarrah Makarewicz at IEEFA. European gas demand is expected to continue to decline. Even for U.S. projects currently under construction. LNG export capacity in 2030 will exceed Europe's forecast demand by 76%. Jarrah Makarewicz says the United States should seriously reevaluate its strategy or risk overinvestment.she presents Data and forecasts on European demand, imports and US export capacity. These projections need to be added to the United States' current thinking on LNG. In January, President Biden suspended approvals for LNG exports.citing the impact on the environment and domestic economy.

Main findings

- European gas demand is expected to decline further by 2030This is also thanks to the introduction of renewable energy, energy efficiency programs, demand management and disruption.

- Even if gasoline consumption decreases, Europe's energy security is being used to justify the construction of LNG import and export terminals.

- The US continues to build more LNG terminals; Considering the project currently under construction; The country's LNG export capacity in 2030 will exceed Europe's projected demand by 76% For cryogenic fuel that year.

- Now is the time to re-evaluate proposed LNG projects to reduce the risk of overinvestment.

Since February 24, 2022 and Russia's full-scale invasion of Ukraine, Europe's energy landscape has changed dramatically. In 2021, 41% of the European Union's gas imports came via pipelines from Russia, 40% from other pipeline suppliers and 19% from liquefied natural gas (LNG).—The combination has changed since 2022.

In May 2022, the European Commission launched the REPowerEU plan to help the region save energy, increase the adoption of renewable energy and diversify its energy supply. The EU recognized the need to reduce dependence on fossil fuels alongside safe and diverse energy sources.

After the introduction of REPowerEU, the energy supply mix changed. In 2022, 9% of EU gas imports will come via pipelines from Russia, 40% from other pipeline suppliers and 41% from LNG.. And 41% of gas continued to be supplied by LNG imports in 2023, according to data from Kpler and Eurostat.

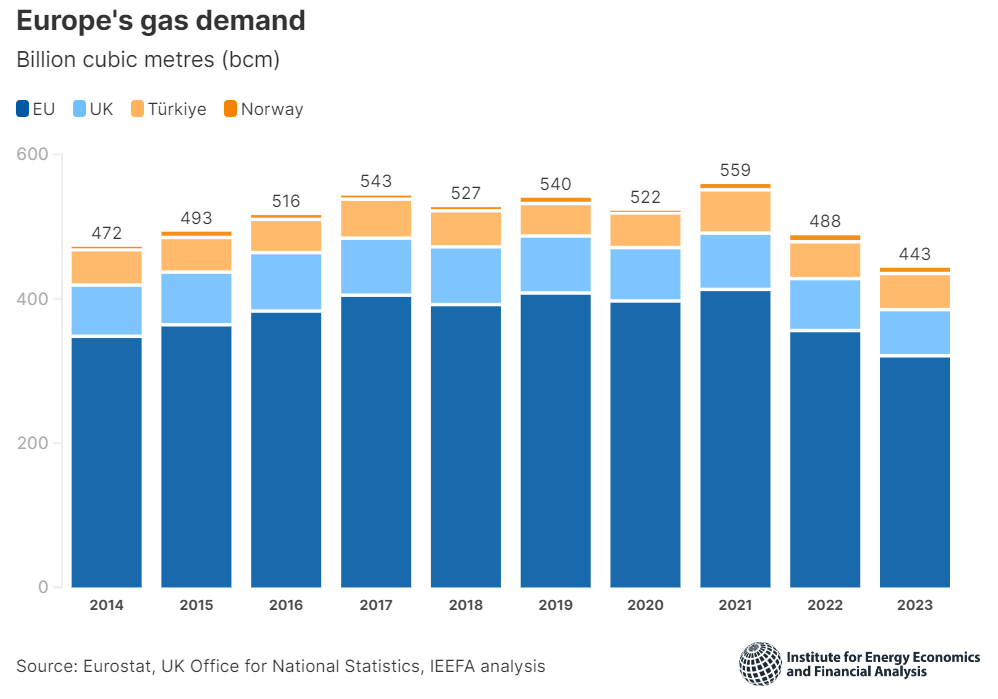

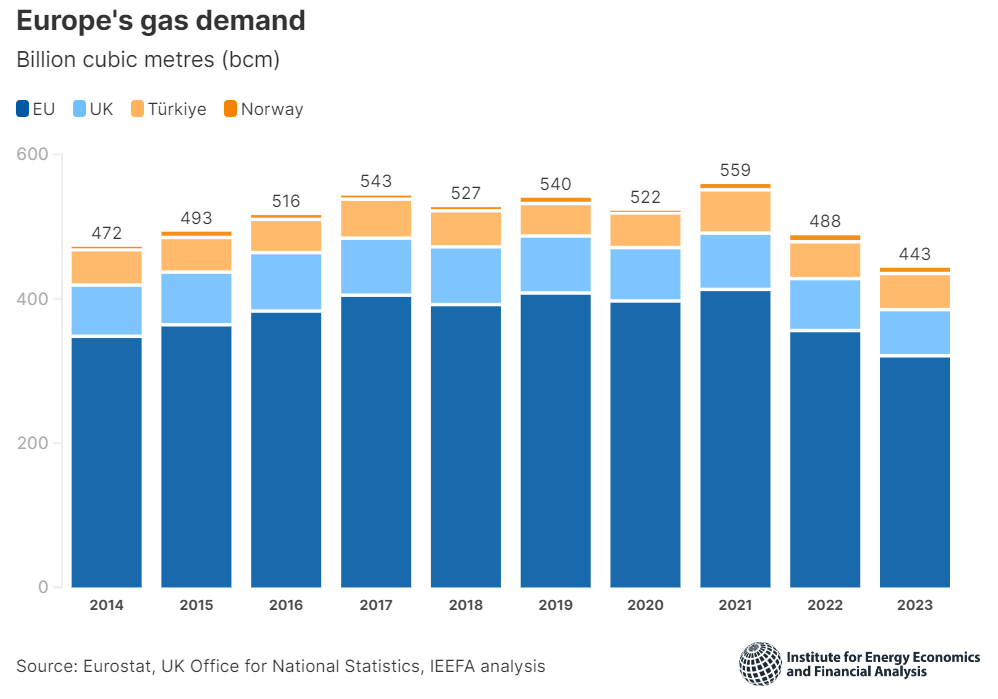

Decline in European gas demand

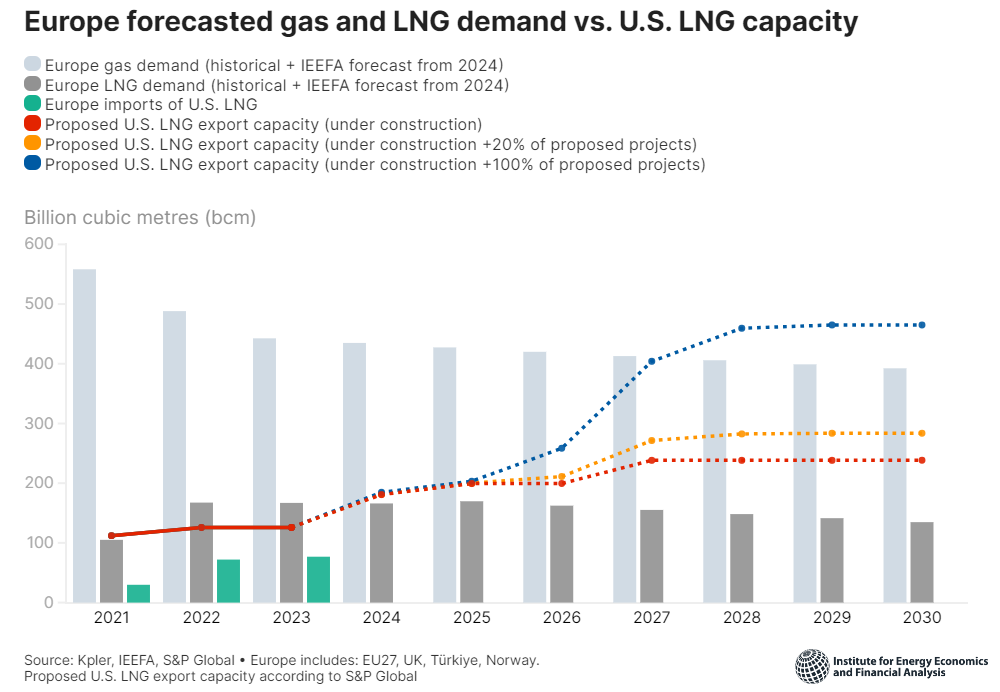

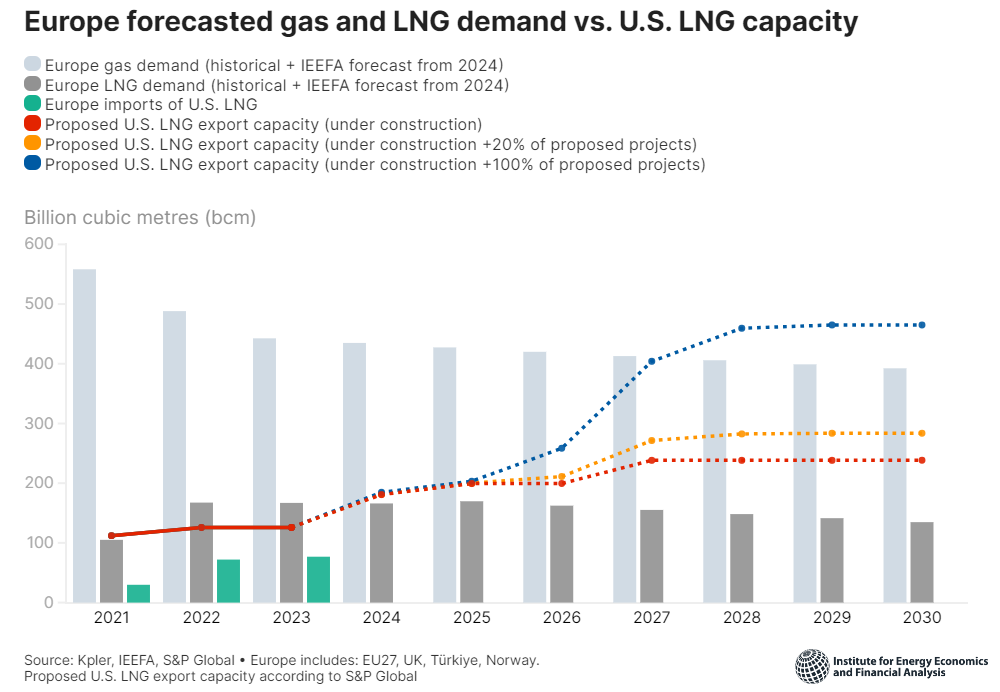

Over the past two years, gas demand in Europe (defined in this analysis as the 27 EU member states, Norway, Turkiye, and the UK) has been driven primarily by the REPowerEU policy, energy efficiency programs, increases in renewable generation, and demand management and disruption. . If these policies and programs continue to be successful; European gas demand in 2030 is expected to fall below 400 billion cubic meters (bcm).

In addition to reducing gas demand, Europe is making significant efforts to diversify its LNG import sources.

LNG imports increased but fell below previous expectations in 2023. According to Kpler, Europe imported around 105 bcm of LNG in 2021, 167 bcm in 2022 and 167 bcm in 2023.

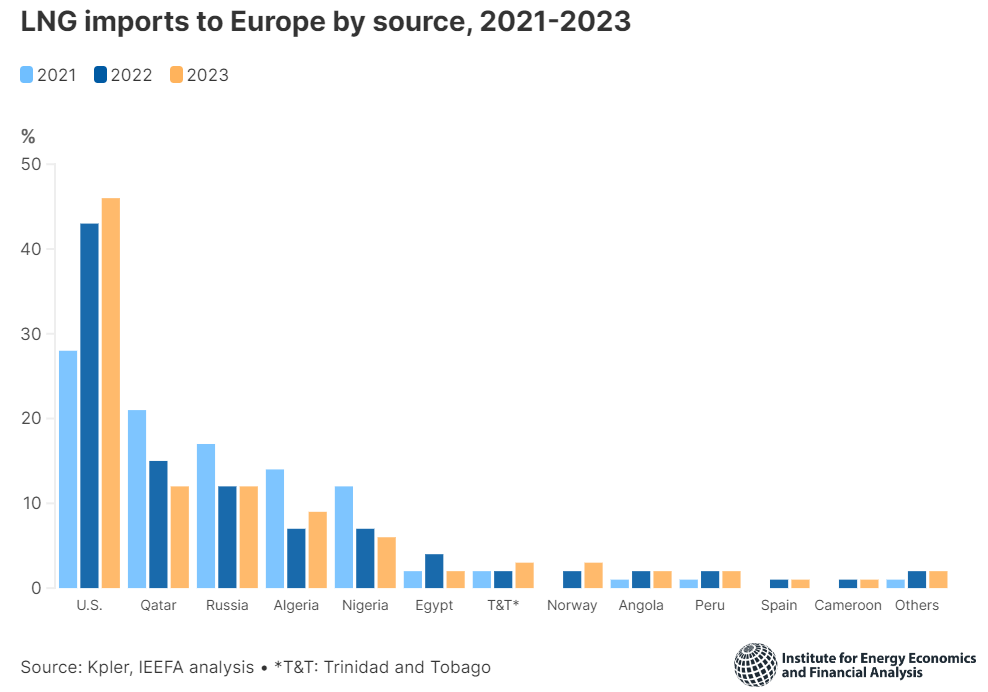

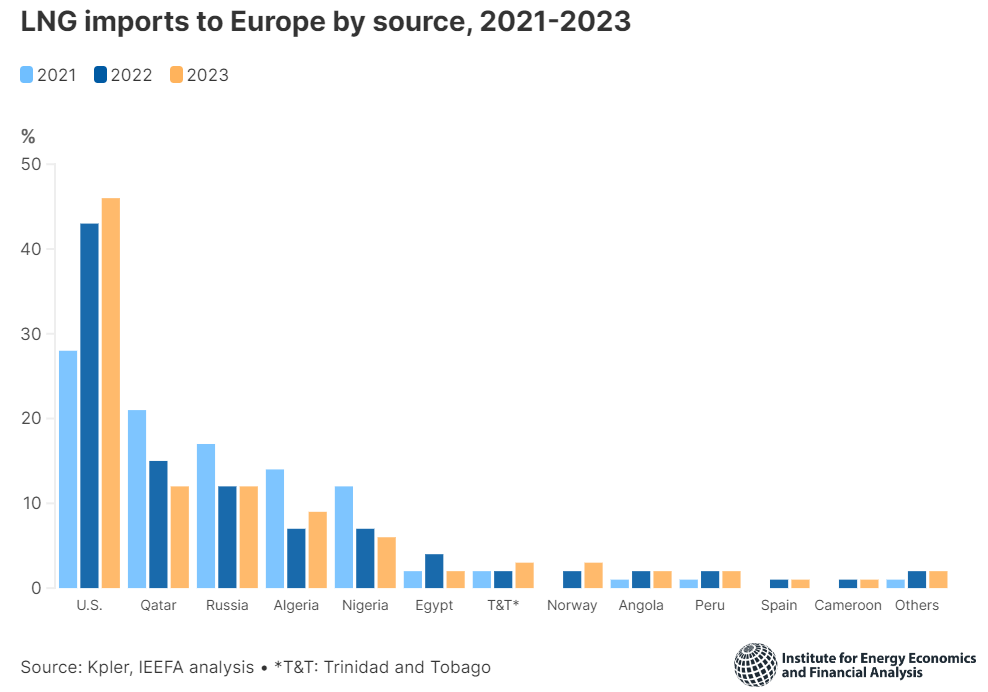

The main sources of LNG imports into Europe are: USA, Qatar, Russia, Algeria, Nigeria. In recent years, the United States has become the largest supplier of LNG to Europe, accounting for 28% of imports in 2021, 43% in 2022, and 46% in 2023.

US LNG imports to Europe in 2023 increased by 7% compared to 2022. Assuming a similar rise next year, US may intend to supply 123 bcm of LNG to Europe in 2030the rest is sourced from various other countries to comply with the diversification of supply concepts.

Expanding US LNG export capacity

While Europe is focused on ways to reduce gas and, in turn, LNG demand, the United States is expanding its LNG export capacity and plans to build new terminals, according to S&P. Even considering the LNG terminals currently under construction, By 2030, U.S. export capacity will be approximately 173 million tons per year (mtpa), or the equivalent of 238 bcm..This number is 76% higher than Europe's projected LNG demand 98 mtpa (approximately 135 bcm) by 2030.

If all of the proposed LNG terminals in the United States are built, the country's LNG export capacity will reach approximately 337 mtpa (approximately 465 bcm) by 2030, exceeding the projected gas demand for Europe as a whole of 284 mtpa (approximately 392 bcm). become.

Risk of overinvestment

once again, European energy security has been used to justify the construction of LNG import and export terminals. Most of these projects were seen as emergency measures to supply gas to Europe, which is facing an energy crisis as Russia's gas supplies dwindle.

However, thanks to Europe's swift response, the crisis has so far been contained. However, the continent cannot rest on its laurels and must continue its efforts to reduce gas consumption, diversify gas import sources and increase renewable energy. Now is the time to re-evaluate proposed LNG projects to reduce the risk of overinvestment.

Also read IEEFA article “The suspension of US LNG export licenses does not threaten the energy security of Europe and Asia.”

***

Ana Maria Jarrah-Makarewitz He is Europe's chief energy analyst. IEEFA

This article is published with permission