Combined travel offered to both corporate and leisure customers will exceed annual travel capacity in 2018 and 2019, according to FCM Consulting's Q4 2023* Quarterly Global Trends Report, citing data from Cirium. is.

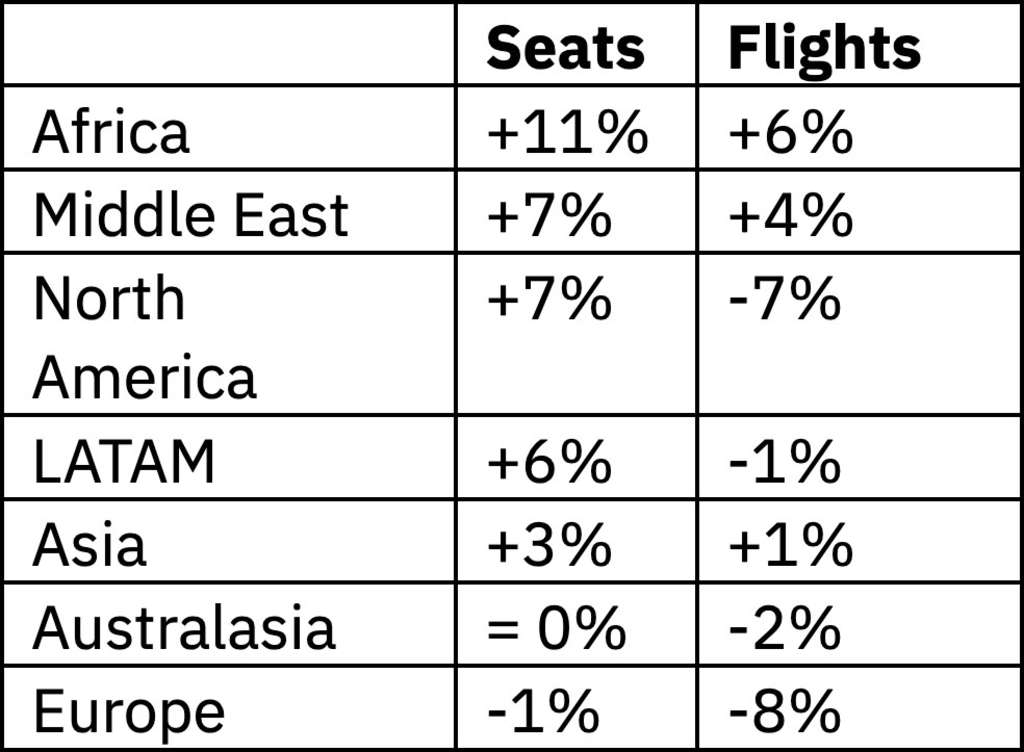

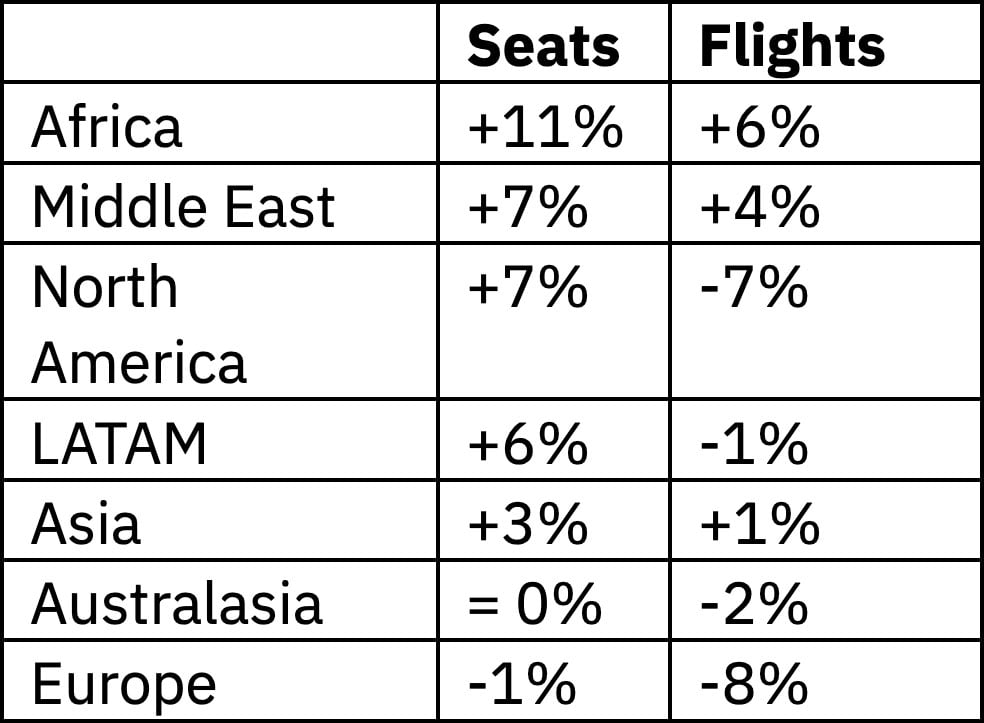

The report also highlighted a key trend that will continue in 2024: fewer flights and more seats. The first half of 2024 is expected to see an increase of +97.9 million (+3.5%) seats and a decrease of -2.1 million (-5.6%) in the number of flights compared to the first half of 2019.

This is the result of fleet configuration changes and schedule changes to meet demand. Careful planning can benefit airline operating costs, staffing, airport slots, and airport costs.

Sunny Sodhi, Managing Director, FCM Travel India said:

Q4 2023 concluded a milestone year with corporate travel being the busiest and least disrupted in four years. Business travelers are more confident than in previous years, and he plans to travel in 2024 to grow his business and connect with customers and colleagues. Across the world's top corporate airlines, he predicts seat availability in 2024 will be 2% higher than in 2019, and flight availability will be 6% lower.

Sodhi said.

American Airlines, Delta Air Lines, United Airlines, China Southern Airlines, China Eastern Airlines, LATAM Airlines Group, Qatar Airways, Cathay Pacific Airways, Singapore Airlines, and Virgin Atlantic are all expected to see seat capacity recover by more than 100 percent. There is. Compared to 5 years ago,

Sodhi concluded.

Economy class fares from Mumbai to London have increased by 25% and economy class fares from Mumbai to Delhi have increased by 24%. Business class fares from Mumbai to London have increased by 13%.

The top five domestic flights flown by business travelers in India are Chennai to Delhi, Delhi to Bangalore, Delhi to Mumbai, Mumbai to Bangalore and Mumbai to Delhi.

When it comes to accommodation, average room prices rose in all regions in 2023 compared to 2022, with Asia seeing the highest increase in the world by $39.

Delhi has the highest average room rate at $249, followed by Bangalore at $192 and Mumbai at $157. Chennai, where the average nightly price is USD 130, recorded the highest increase of 35% compared to Q3 2023.

Sodhi added.

Despite the increased costs, occupancy rates also rose year-on-year in all regions, with occupancy in mainland China, the last major country to reopen its borders, rising 34% to 65% and in Asia excluding China. grew by 17% and India by 1.8%, reaching 70% level of occupancy in 2023.

*This FCM Consulting Quarterly Report is based on global data sourced from FCM Travel and Flight Center Travel Group corporate bookings data for travel from October to December 2023 (Q4 2023). This report uses Cirium air schedule data as of January 18, 2024. Airfare price changes exclude all taxes.

The average hotel room rate (ARR) shown is the average booking rate using corporate booking data from FCM Travel and Flight Center Travel Group. Changes in reservation prices reflect seasonality, supply and demand, reservation lead times, and exchange rate fluctuations. All fares and charges are reported in U.S. dollars unless otherwise noted. STR Hotels data and content is current as of January 2024 for the period ending December 2023.