New car sales in January were lower than Cox Automotive's forecast. This is due to a possible rebound from December's higher-than-expected unit sales, as well as lower-than-expected cold weather across much of the country in mid-month, which held back consumers. return. Total new car sales in January are currently expected to be 1.08 million units, which is lower than our forecast of 1.15 million units, but an increase compared to the same period last year. Compared to December 2023, new car sales in January fell by more than 26%.

January is typically one of the lowest sales months of the year, and last month was a slow month for retailers. In fact, despite some individual highlights, last month's total sales volume was the lowest since reported January 2023. Fleet sales estimates were roughly flat year-over-year, with a minimal increase due to one additional sales day. Retail sales also increased by just over 4%, benefiting from extended sale days. The January sales pace was initially estimated at 15 million units, down from 15.1 million units in January 2023 and the lowest level since March last year, when the market pace struggled to reach 14.9 units.

Cox Automotive continues to believe that the new car market will experience moderate growth over the next year, ending with total sales close to 15.7 million units. The weaker start to January than we expected suggests that the market does indeed want “low growth.”

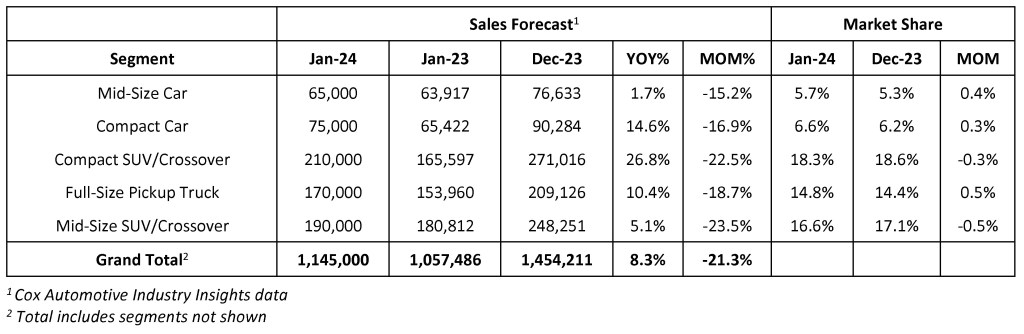

Atlanta, January 29, 2024 – New car sales for January, to be released next week, are expected to show faster growth than last year's product-constrained market. Cox Automotive predicts January sales will increase 8.3% compared to January 2023, with the market still recovering from severe product shortages. January is typically the month with the lowest trading volume in any given year. January trading volume is expected to be down 21.3% month-on-month. Historically, December is the busiest month for trading in any given year.

Cox Automotive expects January's seasonally adjusted annual rate (SAAR), or sales pace, to end at nearly 15.8 million units, down slightly from December's SAAR of 15.9 million but above last year's pace. increased by 700,000 units. SAAR has bounced between 15 million and 16 million through 2023, and this month's results are expected to remain within those ranges.

“January is typically one of the slowest months for auto sales, as December hangovers and cold temperatures keep car and truck shoppers from roaming dealership lots,” said Charlie Chesbrough, senior economist at Cox Automotive. That's one,” he said. “January of this year was no different, with several major storms and frigid temperatures across the country making things even worse, which may have further negatively impacted sales. However, unlike last year, available inventory And incentives are not an issue.”

Fleet sales are expected to contribute significantly to total new vehicle sales in January and throughout 2024. Fleet sales declined slightly in October and November due to the UAW strike, but rebounded in December. The recovery is expected to continue in January, with sales of commercial vehicles and rental cars expected to remain strong. Cox Automotive predicts that fleet sales in 2024 will grow faster than retail sales, increasing more than 7% from 2023.

New car sales forecast for January 2024

The sales day in January was the 25th, one day more than last year, but one day less than last month.

About Cox Automotive

Cox Automotive is the world's largest automotive service and technology provider. Cox Automotive leverages extensive first-party data, powered by 2.3 billion annual online interactions, to customize cutting-edge solutions for car buyers, automakers, dealers, financiers, and fleets. The company has more than 29,000 employees across five continents and a portfolio of industry-leading brands including Autotrader®, Kelley BlueBook®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch®, FleetNetAmerica® and more I have. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately held Atlanta-based company with $22 billion in annual sales. Visit coxautoinc.com or connect via @CoxAutomotive CoxAutoInc on X, CoxAutoInc on Facebook and Cox-Automotive-Inc on LinkedIn.

Media contact:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hales

470 658 0656

dara.hailes@coxautoinc.com