Toyota Motor Corp. is expected to report strong quarterly profit and sales increases when it reports earnings on Feb. 6, thanks to a production recovery amid a global computer chip shortage.

The October-December 2023 period will be the third quarter of the Japanese automaker's 2024 fiscal year, which ends on March 31st. Analysts expect net income to rise 47% and sales to rise 19% to more than $7.2 billion.

In the U.S., Toyota has enjoyed improved inventory, but supply remains well below the industry average. As a result, Toyota was able to increase its sales by his 15%, surpass the US automobile industry and capture a full percentage of the market share. Toyota increased incentives in the quarter, but they are still far lower than before the pandemic. Due to soaring Lexus prices, the average transaction price exceeded $41,000. Higher sales, lower incentives and improved ATP mean Toyota's U.S. operations are steadily contributing to the automaker's bottom line.

Below are data points from Cox Automotive regarding Toyota's quarterly market performance in the United States, one of Toyota's most important markets.

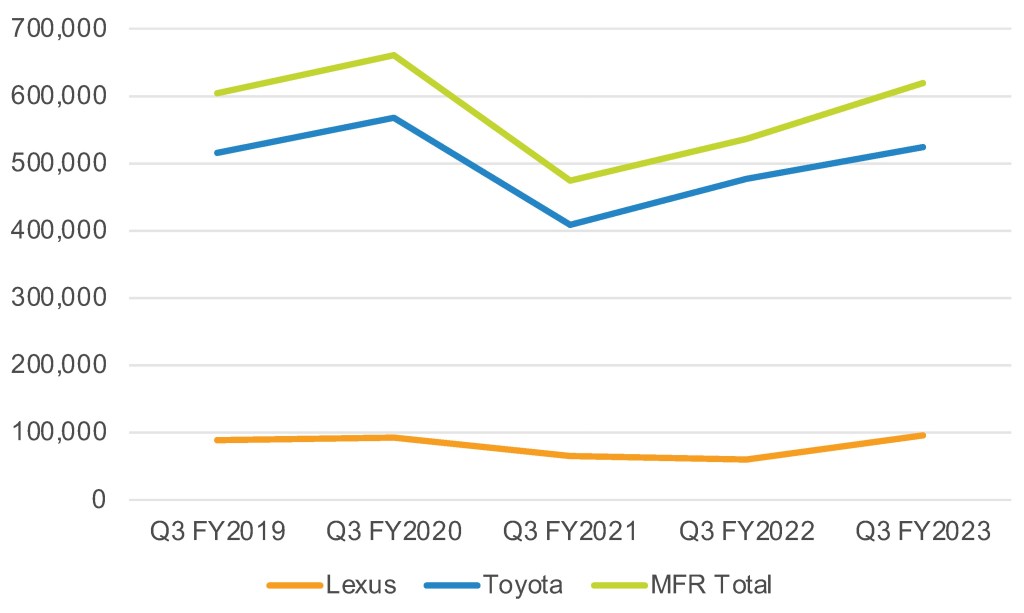

Toyota's US sales increase due to inventory improvement

According to Cox Automotive calculations, Toyota sold 619,661 vehicles in the U.S., up 15% from the same period last year. This was the automaker's second-best sales quarter in at least the past five years. Only the final quarter of the 2020 calendar year exceeded this with more than 660,000 units.

Toyota Motor Corporation U.S. Sales for the Third Quarter of Fiscal Year 2024

Sales of Toyota Motor Corporation's electric models (mainly hybrid vehicles) account for 25-33% of total sales. Globally, 36% of Toyota's sales were electric models.

Toyota brand sales increased by 10% to 523,710 units. As with the automaker as a whole, the quarter's sales were his second-best sales for the brand in the past five years. Only the final quarter of 2020 sold more, with around 568,000 units sold.

Sales by Toyota brand model were mixed. His top-selling RAV4 reported a 37% increase in sales to 132,112 units. Sales of the Corolla, which Toyota says is the most requested model by dealers, increased by 27% to 88,627 units. Sales of Toyota's other mass-market model, the Camry, fell 10% to 72,674 units. Sequoia's sales increased 33%, setting a new record for the quarter. 4Runner sales increased by double digits and Tundra sales increased by 9%. Prius sales increased 3%. Sales of Toyota's only EV, the low-volume BZ4x, increased by 189% to 2,843 units.

Tacoma truck sales fell 10% as the company has the lowest inventory of any of the best-selling models in the United States. Similarly, sales of the Sienna and Venza, which were only available as hybrids, also declined.

The new Grand Highlander sold 23,660 units, at the expense of Highlander sales of just 31,365 units, a 46% decline compared to the same period last year.

Lexus sales rose 60% to 95,941 vehicles, the highest sales volume for the quarter in five years. Lexus' mass-market models recorded double-digit growth.

Sales of the top-selling Lexus RX rose 94% to 30,542 units, approaching sales levels achieved before the pandemic and chip shortage. His NX, his second best-selling Lexus model, increased 32% to 22,241 units. GX rose 39% and ES rose 9%.

Toyota's US market share rises

Toyota outperformed the overall market in the quarter. Industry sales increased by 8%, and Toyota Motor sales increased by 15%. This brought Toyota's overall market share to 15.88%, one percentage point higher than the same period last year and the highest share for the quarter in at least five years.

Lexus accounted for most of the increase, increasing by 0.8 points to 2.46%.

The Toyota brand increased by 0.2 points, with a market share of 13.42%. The Toyota brand's market share has only exceeded this once in the past five years, when it reached 13.53% in the final quarter of 2020.

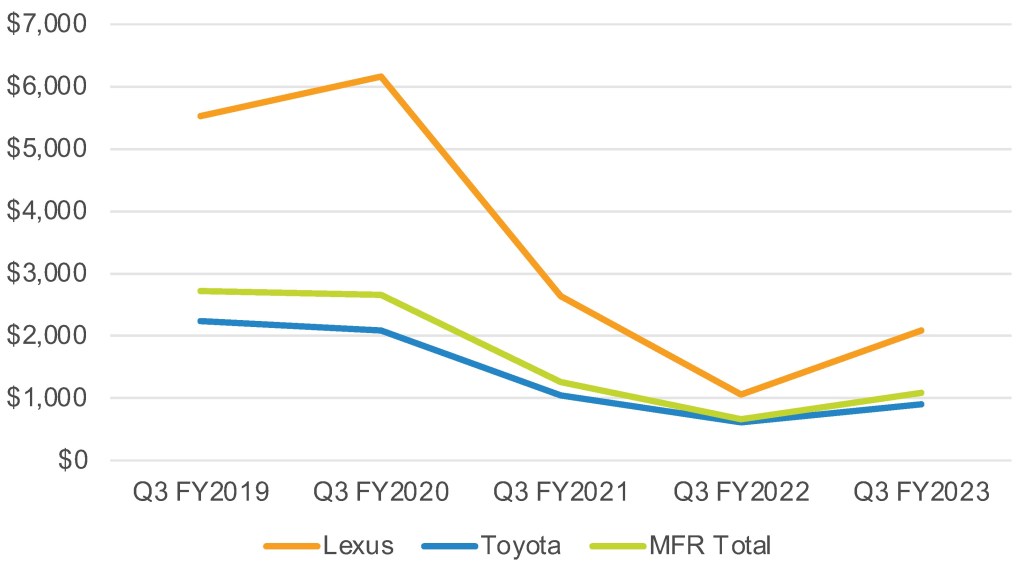

Toyota has raised incentives, but they are still low

Toyota increased its incentives to an average of $1,083 per vehicle, according to Cox Automotive calculations. That's slightly higher than last quarter and 64% higher than a year ago, but still well below pre-pandemic levels, when Toyota spent between $2,500 and $2,700 per vehicle.

Toyota Motor Corporation's fiscal 2024 third quarter U.S. incentive spending

Lexus' incentives have nearly doubled. Up 97% to an average of $2,084 per unit. Before the pandemic, Lexus typically cost him $6,200 per vehicle, up from an average of $4,800.

Toyota brand incentives increased by 47% to an extremely low average of $899 per non-luxury brand vehicle. Before the pandemic, Toyota typically spent $2,500 to $2,700 per vehicle.

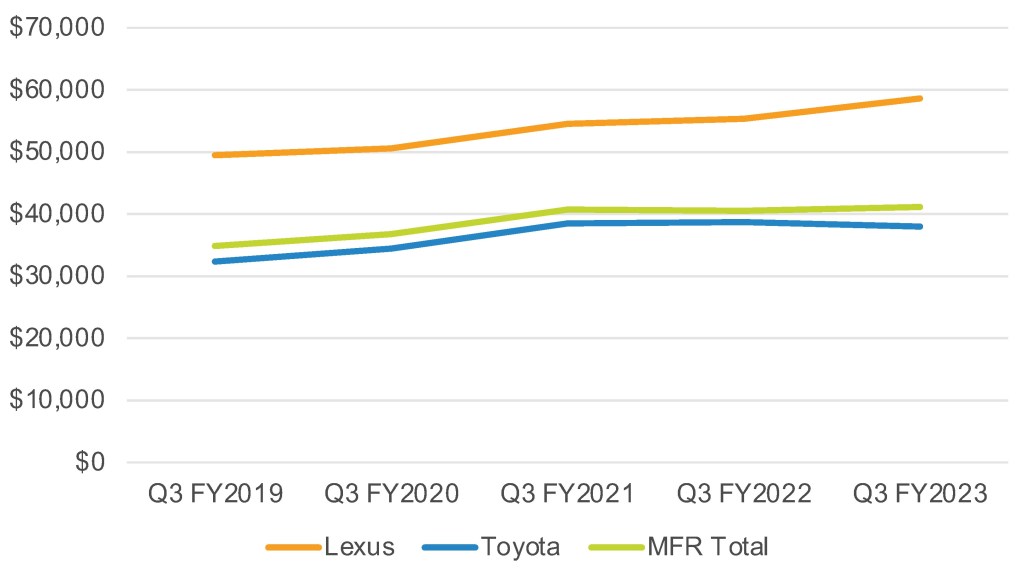

Toyota's average transaction price exceeded $44,000

Toyota's overall average transaction price (ATP) rose 12.8% to $44,403, according to Cox Automotive calculations.

Toyota Motor Corporation U.S. average transaction price for the third quarter of fiscal year 2024

Toyota's ATP increase was primarily driven by Lexus, which rose 6% to $58,641, a record high for the quarter and nearly $9,000 higher than the same quarter in 2018.

RX's ATP rose 7% to $61,791. RC rose 8% to $59,391. These were the highest increases. The rest had a mix of low-single-digit increases and decreases. The LX and LC have Lexus' highest ATP and cost over $100,000. The UX is Lexus' least expensive model, priced at $41,604.

Toyota brand ATP increased 14.6% year-on-year to $44,403, also increasing from the previous quarter. In the final quarter of fiscal 2022 and 2021, Toyota brand ATP was nearly $38,500.

Toyota's ATP brand has been affected by heavy sales of Toyota's cheapest model, the $29,875 Corolla. The hybrid-only Sienna, Prius, and Venza have significantly increased ATP, as does the Highlander, which is also available as a hybrid. The new Grand Highlander's ATP was $58,641, contributing to the Toyota brand's increase in his ATP. Other Toyota models had single-digit ATP increases.

Michelle Krebs

executive analyst

Michelle Krebs is an automotive analyst and award-winning writer with more than 35 years of experience covering the global automotive industry. For the past eight years, she has provided analysis and insight into the automotive industry using a wealth of consumer and industry data from Cox Automotive and its brands, including Autotrader and Kelley Blue Book.