Japan's Nissan Motor Co. announced its October-December results on February 8, hoping to repeat last quarter's performance, when sales growth in most markets saw profits jump by 25%. There is. The results beat analysts' expectations, and the Japanese automaker raised its forecast for the full year ending March 31.

In the U.S., Nissan and Infiniti's combined sales rose just 6% in the final quarter of calendar 2023, lagging the industry's 8% increase. The best-selling Rogue and Titan, which are affordable models, continued to perform well at the end of 2023, but overall sales performance declined due to the withdrawal of the Maxima and declining sales of the aging Murano and Leaf EVs. It has become limited.

As with the industry as a whole, incentives continued to increase and transaction prices softened. However, there is some optimism for the next fiscal year, which begins on April 1st. Vinay Shahani has returned to the automaker as the new senior vice president of U.S. marketing and sales, and Nissan has set goals to increase sales and market share.

Here are some data points from Cox Automotive regarding its quarterly market performance in the United States, one of Nissan's most important regions.

Nissan and Infiniti sales improve, up 6%

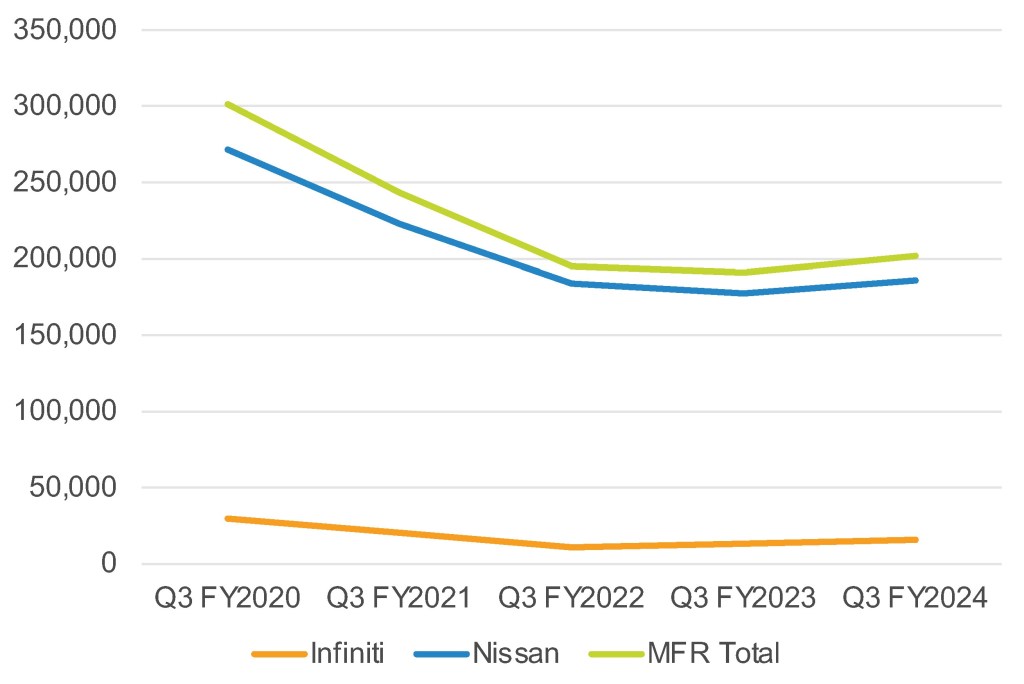

According to Cox Automotive calculations, Nissan Motor Co.'s U.S. sales (total sales of Nissan and Infiniti brands) for the October-December period were 201,747 units, a modest 6% increase from the previous year, but in line with industry growth. The rate fell below 8%. Additionally, this total was about 100,000 units lower than Nissan's pre-pandemic 2019 sales.

Nissan U.S. sales results for the third quarter of fiscal 2024

Nissan's total market share was 5.17%, down 0.12 points from the previous year, underperforming the industry. Infiniti's market share increased slightly from 0.38% last year to 0.41%, while the Nissan brand's market share fell to 4.76%.

In the final quarter of 2023, Nissan brand sales totaled 185,878 units, an increase of just 5% year-on-year. His attractively priced Versa, Sentra and Kicks models improved by 71%, 42% and 71% respectively, contributing to the overall increase by selling a total of 43,771 units. The popular Rogue recorded a year-over-year increase of 7% or 60,367 units. Nissan Titan pickup trucks recorded sales of 3,782 units, an increase of 47%.

However, sales of the Frontier, Maxima, Murano, and Pathfinder were sluggish. Sales of the Maxima, which has been discontinued, decreased by 53% to 981 units, and sales of the Pathfinder decreased by 25% to 15,268 units. While Nissan's newest EV entrant maintained sales growth with 3,765 units sold in the quarter, the Leaf saw a sharp decline of 57% to 1,348 units.

Nissan brand U.S. executives told dealers attending the recent NADA show that they plan to retail 756,000 vehicles in the next fiscal year, which begins April 1, for a retail market share of 6.1%. Ta. Nissan's market share for the full year of 2023 was 4.8%.

Proving that the luxury brand still enjoys steady business, Infiniti sales rose 17% to 15,869 units. The Infiniti QX60 SUV continued to see sales increase, posting a 12% increase to 6,959 units. At the same time, Q50 sales increased by 114% to 1,179 units. “QX80” also increased by 36%, with 3,471 units sold. Sales of the QX50 increased by 9% to 2,788 units.

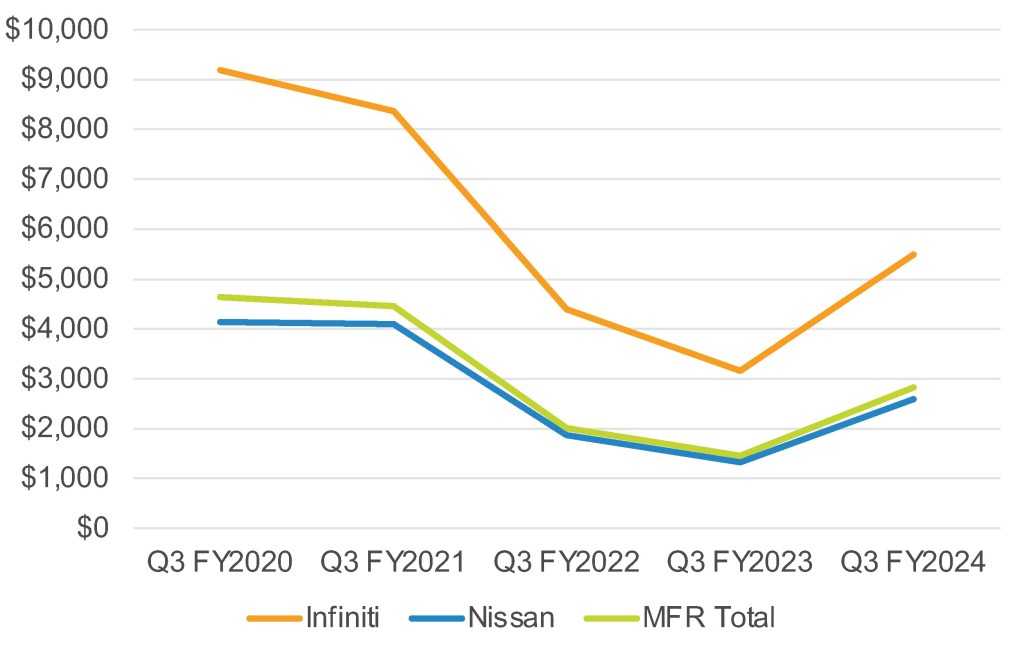

Nissan increases incentives to average $2,823 per vehicle

Nissan Motor Co. has increased its incentive spending, which is already typically high for the industry. Cox Automotive calculates that total incentive spending increased 94% year-over-year to an average of $2,823 per vehicle. Across the industry, automakers spent on average $2,511 per vehicle.

Nissan U.S. Incentive Spending for Third Quarter of Fiscal Year 2024

Nissan brand incentives increased 96% to an average of $2,594 per vehicle, up from an average of $1,326 in the same quarter last year.

Infiniti's incentives for the quarter were up 74% to an average of $5,503 per vehicle, still below pre-pandemic numbers in 2018 and 2019, but on the rise.

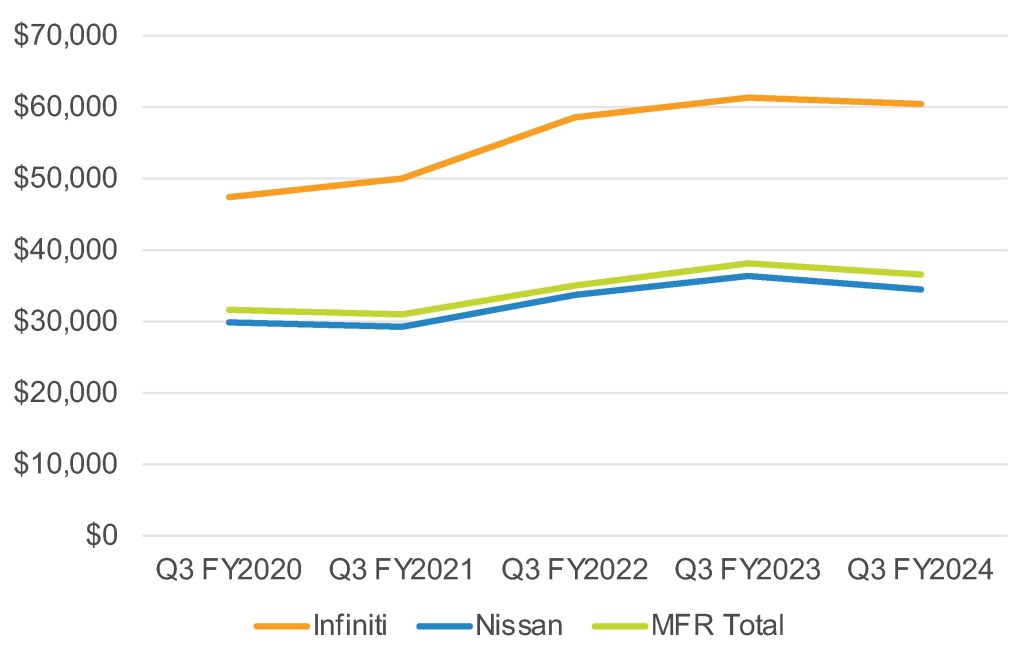

Nissan's average trading price fell 4% to $36,597.

The Nissan brand's average transaction price (ATP) in the final quarter of 2023 was $34,564, down 5.1% year-on-year. Cox Automotive's calculations show that most Nissan models experienced a drop in ATP, with the Versa down 0.4% and the Leaf down 4.1%.

Average Nissan transaction price in the U.S. for the third quarter of fiscal 2024

Infinity's ATP also fell over 1.5% to $60,418. Almost all models reduced ATP by 1% to 9%. Only one of his models, the Q50, saw his 0.3% increase.

Erin Keating, Executive Analyst, Senior Director of Economic and Industry Insights, Cox Automotive