Hyundai Motor Company set records in 2023 for U.S. sales as a company and for each of its three brands: Hyundai, Kia and Genesis.

The South Korean automaker, which announced its fourth-quarter and full-year results on Jan. 25, ended 2023 as the fourth-largest U.S. automaker by vehicle sales, surpassing Stellantis, Honda, and Nissan. In 2019, before the pandemic, the automaker ranked seventh.

Hyundai ended the year with strong fourth-quarter sales in the United States. Like the industry as a whole, automakers significantly increased incentives at the end of the year. However, the year-on-year comparison to 2022 is overstated. That's because incentives were very low a year ago due to inventory shortages caused by a global computer chip shortage. Almost all automakers recorded significant year-over-year increases in incentive spending. Hyundai sought to increase its average transaction price (ATP), but like the industry as a whole, price growth slowed significantly through 2023 as inventory levels increased.

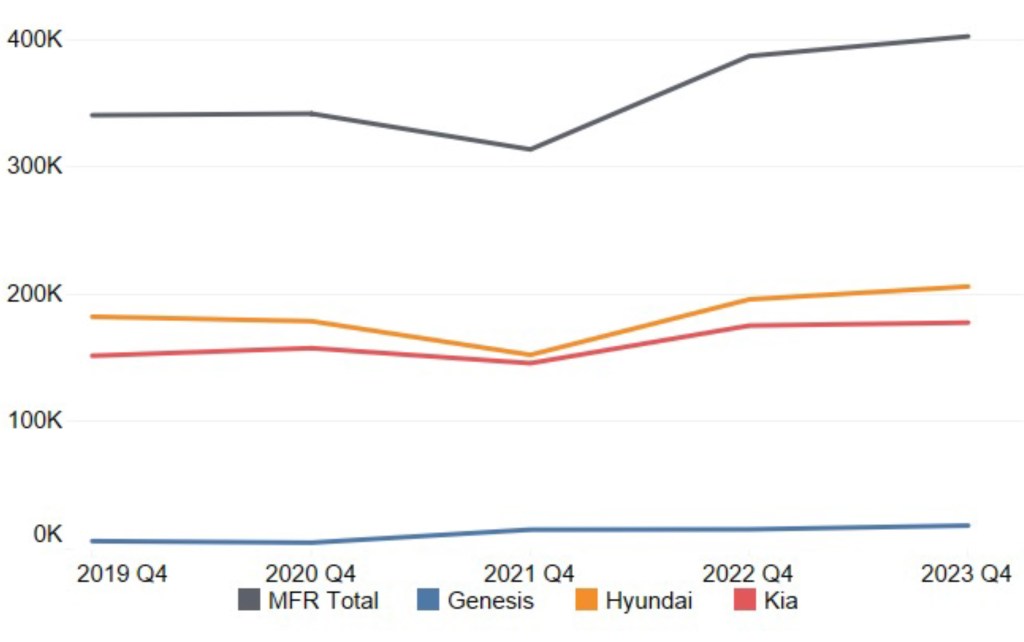

The following is fourth quarter data from Cox Automotive for Hyundai Motors in the United States, one of the company's most important global markets.

Hyundai Motor's sales in 2023 hit record high

Hyundai Motor sold 402,339 vehicles in the fourth quarter, an increase of 4% from the same period last year. According to Cox Automotive's calculations, in the second, third and fourth quarters of 2023, the company surpassed the 400,000-unit mark for the first time in those quarters.

Hyundai Motor Company's US sales results for the fourth quarter of 2023

The Hyundai brand sold 206,048 units in the fourth quarter, up 5% from the last quarter of 2022. This was the first time the Hyundai brand surpassed his 200,000 unit mark for the fourth quarter.

Sales performance for Hyundai models during the quarter was mixed. But its volume leadership has lifted the brand. The best-selling Tucson SUV sold 56,444 units, an increase of 14% year-over-year and significantly above past fourth-quarter sales levels. Palisade also showed significant growth, with sales increasing by 62% to a record 30,652 units for the quarter. Ioniq5 EV sales nearly doubled to 8,621 units. Kona's sales increased 23%. In contrast, sales of the Sonata, Venue, Santa Cruz, and Elantra were down by double digits.

For the full year, Hyundai brand sales exceeded 800,000 units, exceeding the previous record of 768,057 units set in 2016 and increasing by 11% from 2022. Hyundai attributed its performance to steady growth in retail sales, expansion of its EV line and large portfolio of SUVs. , and a small Santa Cruz pickup truck was added.

Kia reported fourth-quarter sales of 177,777 vehicles, up just 1% year-over-year. The brand used to lead Hyundai in sales, but it slipped back in the quarter.

With the exception of K5 and Forte vehicles, most of Kia's mass-market models reported a decline in sales. However, Carnival sales nearly quadrupled to 10,514 units. Sales of Kia Motors' EV6 electric vehicle increased by 37% to 4,081 units.

Kia Motors' annual sales totaled 782,451 vehicles, an increase of 13% from 2022 thanks to EVs and crossovers, breaking the previous record set in 2021.

Through 2023, Kia's inventory levels were among the lowest in the industry, surpassed only by Toyota and Honda. Kia ended the year with improved supply, but still below average, according to an analysis of vAuto inventory data from Cox Automotive.

Genesis had the highest sales growth rate of any Hyundai brand, with sales increasing 19% to 18,514 units, surpassing Nissan's Infiniti sales. Genesis sales were led by the GV70 with 7,218 units, up 28% year over year, and the GV80 with 6,014 units, up 23%.

Genesis sales rose 23% from 2022 to nearly 70,000 units for the year, thanks to new electrification routes and a growing dedicated dealer network.

Hyundai Motor maintains market share of over 10%

According to Cox Automotive calculations, Hyundai Motor's market share fell slightly from the fourth quarter of last year, but was still above 10% at 10.31% (down from 10.71%).

Genesis was the only brand with a higher market share than a year ago, rising from 0.43% a year ago to 0.47%, the highest for the fourth quarter. Hyundai's market share fell from 5.43% to 5.28%. Kia Motors' market share fell from 4.86% to 4.56%. Still, both brands achieved their second-highest market share in the fourth quarter ever.

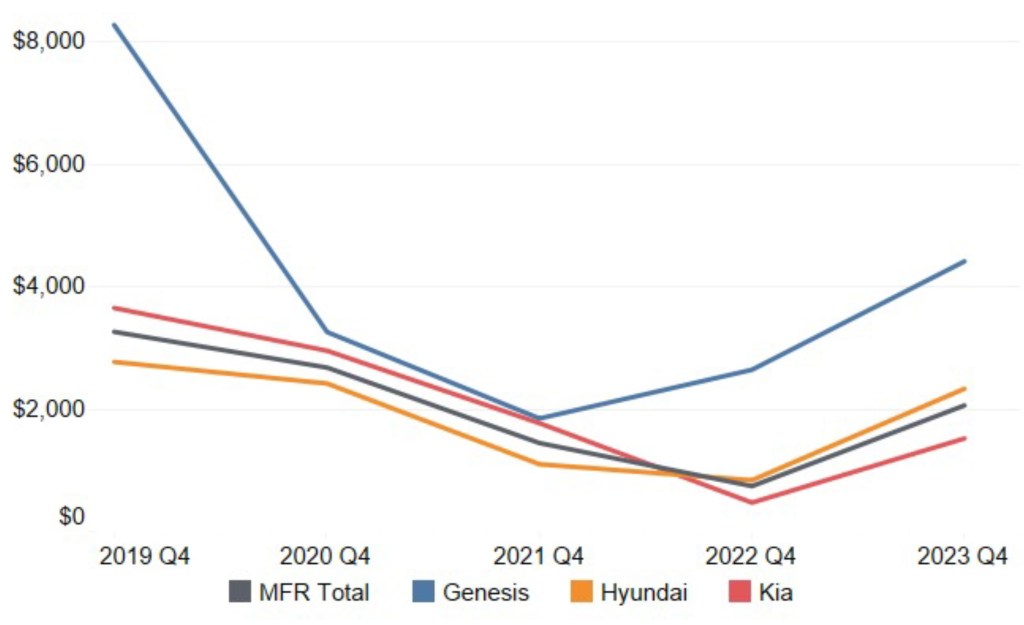

Hyundai Motors strengthens incentives.Remains lower than before the pandemic

Hyundai has significantly increased incentives in the final quarter of 2023 compared to a year ago. But incentives were historically low a year ago, with inventories mostly down due to chip shortages.

Hyundai Motor Company’s US Incentive Fee for Q4 2023

Incentives across all three brands increased a total of 178% to an average of $2,017 per vehicle, compared to an average of $746 per vehicle a year ago, according to Cox Automotive calculations.

Kia Motors had the biggest price increase, rising 222% to an average of $1,521 per vehicle. Hyundai saw a smaller but significant increase, increasing by 178% and paying a higher average price per vehicle at $2,334. Genesis had the highest incentives at $4,416 per car, an increase of 67%.

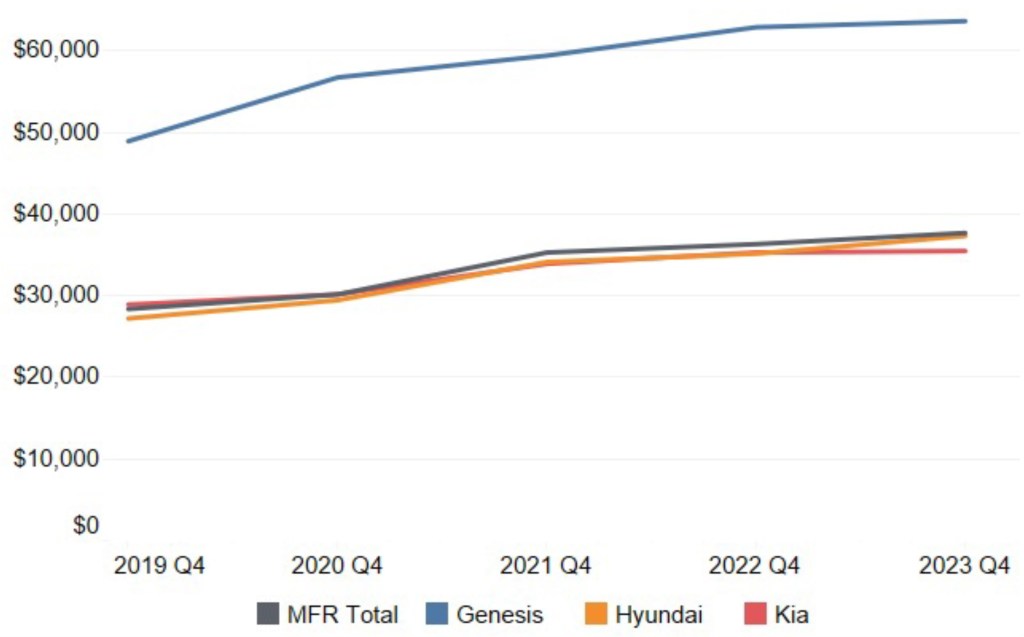

Hyundai Motors ATP rises nearly 4% to $37,700

Hyundai's overall ATP rose nearly 4% to $37,700, according to Cox Automotive calculations. This was the highest ATP for the fourth quarter and higher than any quarter in 2023.

Hyundai Motor Company US average trading price for Q4 2023

Genesis had the highest ATP at $63,604, up 1% year over year. The ATP for all models except the G70 was over $50,000, but the G70 didn't reach that. The Genesis model with the highest ATP was the G90 at $98,092, followed by the GV80 at $74,268, an increase of 2% from the previous year. The G80 saw the biggest price increase, increasing 4% to $67,637.

The Hyundai brand made the biggest profit. ATP increased 6% to $37,308, a record high for the fourth quarter. Nexo, a low-volume hydrogen fuel cell vehicle, had the highest ATP as a brand, increasing 10% to $61,482. The ATP for both Ioniq5 and Ioniq6 EV was over his $50,000. The cars with the lowest ATP were the Venue and Elantra, both well below $30,000.

Kia's ATP was roughly unchanged from a year ago at $35,456. The new EV9 electric SUV is Kia's most expensive model, with an ATP of $71,868. At the other end of the price spectrum, the Kia Forte, Soul, and Rio all have ATPs under $25,000, making them one of the most affordable offerings in the industry. Production of the Rio will end after the 2023 model year. The biggest gainer in ATP was Seltos, which rose 5% to $29,591.

Michelle Krebs

executive analyst

Michelle Krebs is an automotive analyst and award-winning writer with more than 35 years of experience covering the global automotive industry. For the past eight years, she has provided analysis and insight into the automotive industry using a wealth of consumer and industry data from Cox Automotive and its brands, including Autotrader and Kelley Blue Book.