Last year ~ around April ~ i wrote to you On the increasing vulnerability of the commercial real estate sector. In particular, how much were small and medium-sized banks at risk?

High vacancy rates, falling rental prices, oversupply and rising interest rates are all weighing on the industry and its financiers.

But to provide context, I wrote:

“…It is important for banks to remember that: Black box – A.k.a. something with an internal structure that is usually hidden or mysterious to the viewer. Even the best analysts don't actually know the true value of a bank loan book. But one thing is clear: the commercial real estate sector is becoming increasingly vulnerable. Along with that, so do the smaller banks that lent them money. A black swan is lurking…”

Now, I don't particularly like quoting myself. But what I'm about to tell you is important.

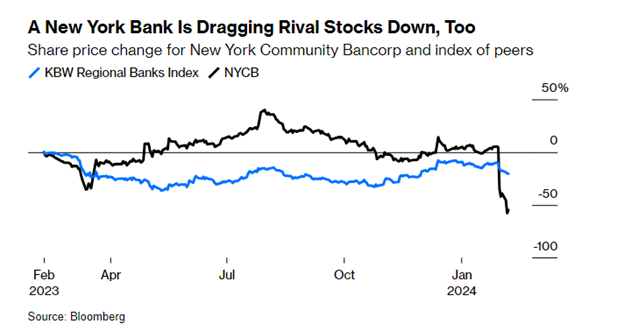

In other words, the local banking sector is shook later “Surprisingly” Q4 2023 earnings are terrible New York Community Bancorp (NYSE: NYCB) – Bank stocks are down about 50% since January 30th (as of this writing)th2024.

Some of you may remember this bank.it had Acquired $40 billion worth of assets A victim from New York Signature Bank, which failed last year (one of the victims after the Silicon Valley Bank collapse).

So what led to this brutal sale of NYCB?

There are several points, let's take a closer look Key Point:

- They cut their dividend by 71% to strengthen their balance sheet.

- Moody's downgraded the company's credit rating to junk status territory.

- It incurred a “surprise” loss of $260 million in the fourth quarter of 2023, reflecting deterioration in loans related to commercial real estate (particularly office).

- Reserves for loan losses soared to $552 million, more than 10 times the consensus estimate.

- The bank is now considering selling its distressed assets sooner than originally hoped.

So, in summary, the main cause of the pain is the weakening commercial real estate market, which has forced NYCB to deal with mounting losses.

Of course, NYCB grew in size as it absorbed the assets of the former NY Signature Bank. Therefore, banks will need higher capital requirements (i.e., they will need to set aside more cash).

The company also announced the new appointment of Alessandro (Sandro) Dinero as Executive Chairman, effective Wednesday.

But sudden changes in leadership usually do not inspire confidence. Rather, it increases uncertainty.

And if there's one thing markets hate, it's uncertainty.

Meanwhile, NYCB's newly appointed executive chairman Said He said on a conference call with analysts Wednesday that the company will do what it needs to do to build capital (sell assets such as loans) and reduce its concentration in commercial real estate as soon as possible.

“If we have to shrink, we shrink.” Dinero said. “If we have to sell non-strategic assets, we will do so.”

Turning risk like a hot potato: Buyer beware

Of particular note is that, in general, I think banks have so far refrained from selling bundles of mortgages to private lenders and hedge funds.

why? That's because many of these long-term loans are being eroded by skyrocketing interest rates.

Remember, as interest rates rise, bond prices fall. So, thanks to the Federal Reserve's interest rate hikes over the past two years, banks are still saddled with hefty unrealized losses on investments, amounting to a staggering $700 billion as of Q3 2023. It will amount to a large amount.

As a result, banks have been selling off-the-books short-term debt such as auto loans (which have not been as affected by interest rate hikes as long-term investments).

Still, “synthetic securitization” is beginning to make inroads into the U.S. market as banks look for ways to manage capital constraints.

Simply put, in synthetic securitization, banks purchase credit protection for a portfolio of loans from investors (hedge funds, pension funds, insurance companies, etc.). Therefore, if a loan in the portfolio defaults, the investor repays the bank for the loss incurred on the loan in the portfolio.

To “hedge” losses (avoid risk), consider things like credit default swaps, credit guarantees, and other derivative contracts.

Sounds like a good deal, right?

Banks can sell risk to reduce exposure to specific sectors and free up cash. Meanwhile, buyers (mainly insurance companies and hedge funds) receive attractive spreads.

Well, the problem is just that shift Risk may be in other hands. It will not be deleted.

This is a problem, but there is one more point I would like to emphasize. . .

The game of confidence: uninsured deposits are a problem

My big concern here is that banks can try to transfer as much risk as they want, but if the underlying loans, especially commercial real estate, start defaulting or deteriorating, investors may walk away. (Who would try to catch it?) A falling knife? ).

So if the commercial real estate woes continue, which I believe they will, it could start to impact bank confidence.

And as a bank, no A problem worse than a crumbling confidence.

For example, if customers start seeing headlines about their main bank selling assets to raise funds and facing an increase in loan defaults, they may start withdrawing their funds.

something like, “Hmm, that's a problem. The stock price of the bank where I keep all my savings has just plummeted. It might be better to transfer your savings. ”

essentially,it is How banks often fail is because they can't sell assets fast enough to raise cash for depositors who want to sell them. As a result, the market is forced to sell at a significant discount.

But here's where things get interesting. . .

The deposits these banks rely on are “volatile” because many exceed the government's $250,000 per account insurance limit. That means these deposits are over $250,000 FDIC insured.

For example, if Bank A has $1,000,000 and it fails, you will only get $250,000 back from the FDIC alone. You could incur a loss of $750,000.

To emphasize the scale of this point, uninsured deposits (as of May 2023) 40% of all deposits (compared to just 20% 30 years ago). And these uninsured deposits are a potential problem for banking stability, especially in the era of online banking (and thus speed of transfers).

As we saw last spring, uninsured deposits are the first to go, and banks can quickly become insolvent.

To make matters worse, the bank traded These capricious (uninsured) deposits are placed in illiquid loans such as commercial real estate.

Therefore, the decline in confidence that leads to individuals withdrawing their money from banks will force them to sell such illiquid loans in the market, possibly incurring huge losses.

summary

As NYCB's latest financial results show, the problem now is commercial real estate debt, which has turned as sour as milk on a porch in an Arizona summer.

And unfortunately, I don't think banks will be able to help by shifting the risk.

why? Tenants are cutting leases as landlords face higher interest rates than they can afford to pay, and landlords struggle to raise rents as excess capacity squeezes margins.

This surge in supply is causing many landlords to struggle to fill vacancies and, in some cases, motivating them to lower asking rents (a.k.a. more supply than demand).

For example, the median asking rent in the US in November was $1,967, down -2.1% year-over-year. Largest annual decline rate Since February 2020, it has fallen -0.6% from October.

This is great for rental seekers. But for commercial real estate investors, landlords, and banks, this isn't great.

It's always a double-edged sword, right?

It is important to be aware of the contagion effects of further problems in commercial real estate.

Perhaps NYCB was a one-off.

But maybe that wasn't the case.

As always, just a little food for thought.