-

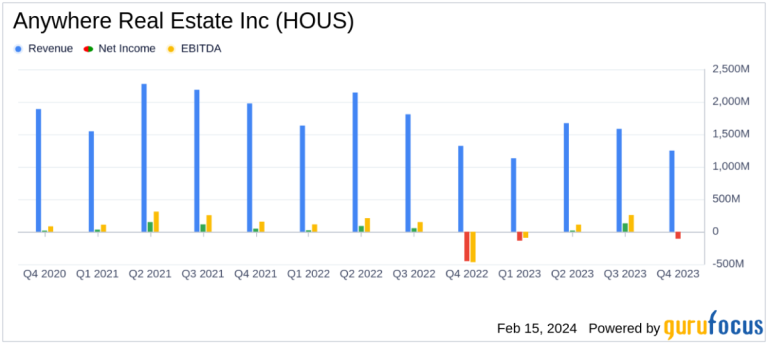

revenue: Reported to be $5.6 billion, down 18% from the previous year.

-

net loss: For the year, we reported a net loss of $97 million.

-

Operating EBITDA: Achieved $200 million due to the impact of litigation reserves.

-

debt reduction: Reduced debt by $308 million through various strategic actions.

-

Cost reduction: Achieved cost savings of approximately $220 million.

-

free cash flow: Generated free cash flow of $67 million.

On February 15, 2024, Anywhere Real Estate Inc (NYSE:HOUS) released its 8-K report detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company is a global leader in residential real estate services. operates through his Anywhere Brands, Anywhere Advisors, and Anywhere Integrated Services divisions, with the majority of his revenue coming from his Anywhere Advisors segment.

Anywhere Real Estate Inc. has demonstrated resilience with meaningful results despite facing a challenging real estate market. Ryan Schneider, the company's president and CEO, cited competitive advantages and strategic initiatives aimed at delivering value to distributors, franchisees and shareholders. expressed optimism. Charlotte Simonelli, Executive Vice President, CFO and Treasurer, highlighted the company's performance in generating significant operating EBITDA and free cash flow, reducing debt and effectively managing cash.

The company's financial performance was characterized by an 18% year-over-year decline in sales to $5.6 billion, primarily due to a 19% decline in residential sales transaction volume. Net losses for the year were reported at $97 million. However, the company managed to generate operating EBITDA of $200 million, which was heavily impacted by approximately $50 million in litigation reserves. Anywhere Real Estate Inc also succeeded in reducing its debt by $308 million and realized cost savings of approximately $220 million. Free cash flow was $67 million.

Despite financial challenges, Anywhere Real Estate Inc. has been recognized for its work culture and innovation by being named one of Fortune's 2023 America's Most Innovative Companies and Forbes' World's Best Employers. Selected for the 3rd year in a row on the “Lord'' list.

Financial analysis and outlook

Looking ahead to 2024, Anywhere Real Estate Inc expects to see an increase in typical seasonal transaction volumes and expects to see additional cost savings of approximately $100 million. However, these estimates are subject to macroeconomic and housing market uncertainties, including inflation, affordability, inventory constraints, competition, litigation, and regulatory uncertainty.

The balance sheet shows total debt, excluding cash and cash equivalents, of $2.5 billion at the end of 2023. As of December 31, 2023, the Company's senior collateral leverage ratio was 1.35x and its net debt leverage ratio was 7.8x. .

Investors and interested parties can access a replay of the webcast discussing full-year 2023 results on the Company's Investor Relations website.

Anywhere Real Estate Inc's performance in a challenging market highlights the importance of strategic financial management and the ability to adapt to difficult circumstances. The company is focused on reducing costs and debt, and has a reputation for innovation and workplace excellence, so it may be able to take advantage of market improvements in the future.

For more information, see Anywhere Real Estate Inc's full 8-K earnings release here.

This article first appeared on GuruFocus.