key insights

-

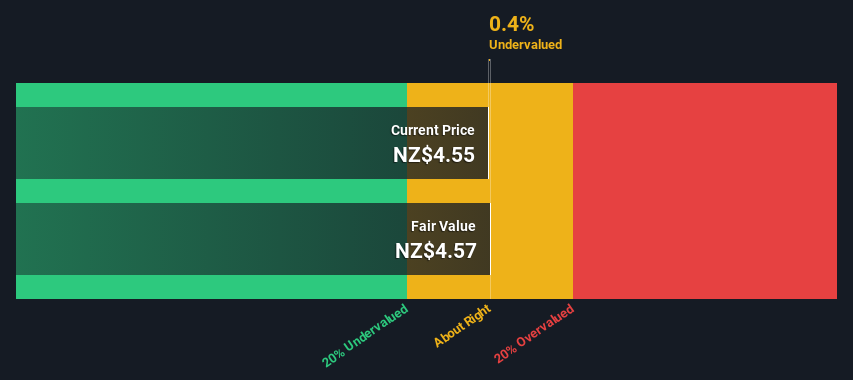

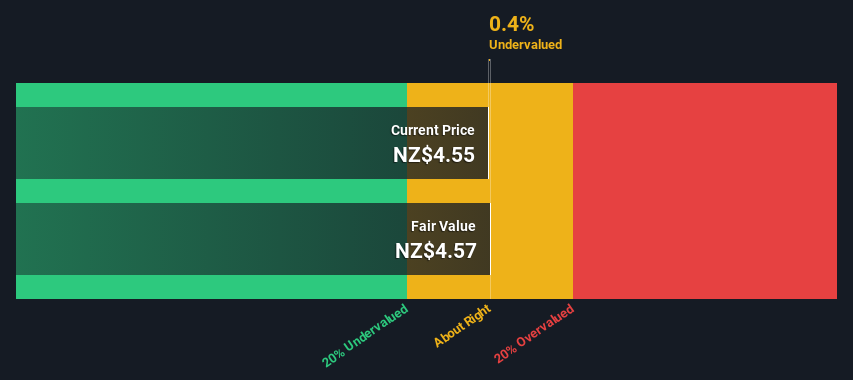

Using the dividend discount model, Turners Automotive Group's fair value estimate is NZ$4.57.

-

The current share price of NZ$4.55 suggests that Turners Automotive Group may be trading close to its fair value.

-

Compared to the industry average discount to fair value of 18%, Turners Automotive Group's competitors appear to be trading at even greater discounts.

Today we'll run through one method of estimating the intrinsic value of Turners Automotive Group Limited (NZSE:TRA) by discounting its expected future cash flows to their present value. Our analysis uses a discounted cash flow (DCF) model. It may seem very complicated, but it's actually not that much.

Keep in mind that there are many different ways to value a company, and as with DCFs, each method has advantages and disadvantages in certain scenarios. If you still have doubts about this type of valuation, take a look at the Simply Wall St analysis model.

Check out our latest analysis for Turners Automotive Group.

calculate numbers

Turners Automotive Group operates in the specialty retail sector, so we need to calculate its intrinsic value a little differently. This approach uses dividends per share (DPS) because free cash flow is difficult to estimate and is often not reported by analysts. Although this often undervalues the stock, it can still be a good comparison to its competitors. The 'Gordon Growth Model' is used, which simply assumes that dividend payments continue to increase at a sustainable growth rate forever. For a variety of reasons, a very conservative growth rate is used that cannot exceed the company's gross domestic product (GDP). In this case, we used the five-year average of the 10-year government bond yield (2.4%). The expected dividend per share is discounted to its current value at a cost of capital of 8.7%. Compared to the current share price of NZ$4.6, the company appears to be at about fair value, representing a 0.4% discount to the current share price. It is best to view this as a rough estimate, not accurate to the last cent, as the assumptions in the calculations have a significant impact on the valuation.

Value per share = Expected dividend per share / (discount rate – perpetual growth rate)

= NZ$0.3 / (8.7% – 2.4%)

= 4.6 New Zealand Dollar

Important prerequisites

The above calculation relies heavily on two assumptions. One is the discount rate and the other is the cash flow. Part of investing is making your own assessment of a company's future performance. So check your assumptions by doing your own calculations. Additionally, DCF does not give a complete picture of a company's potential performance because it does not take into account the cyclicality of the industry or the company's future capital requirements. Given that we are considering Turners Automotive Group as a potential shareholder, the cost of equity is used as the discount rate, rather than the cost of equity taking into account debt (or weighted average cost of capital, WACC). For this calculation, we used 8.7% based on a leverage beta of 1.253. Beta is a measure of a stock's volatility compared to the market as a whole. Beta values are derived from industry average beta values for globally comparable companies and are constrained to a range of 0.8 to 2.0, which is a reasonable range for stable businesses.

SWOT analysis of Turners Automotive Group

strength

Weakness

opportunity

threat

For the future:

Although important, DCF calculations are only one of many factors that businesses need to evaluate. The DCF model is not a perfect stock valuation tool. Rather, the best use of DCF models is to test certain assumptions and theories to see if a company is undervalued or overvalued. For example, a small adjustment to the terminal value growth rate can dramatically change the overall result. In the case of Turners Automotive Group, there are three additional items to evaluate.

-

risk: For example, I discovered the following: 3 warning signs for Turners Automotive Group (1 can't be ignored!) Here's what you need to know before investing.

-

management:Are insiders capitalizing on market sentiment regarding TRA's future prospects by buying more shares? View our management team and board analysis with insights into CEO compensation and governance factors.

-

Other high quality alternatives: Do you like good all-rounders? Explore our interactive list of quality stocks to figure out what else you're missing.

PS. The Simply Wall St app provides daily discounted cash flow valuations for all stocks on the NZSE. If you want to know the calculations for other stocks, please search here.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.