After the six-week strike by the UAW ended, Stellantis estimated it had lost about $3 billion in revenue and less than $800 million in profits. That's less than the losses experienced by General Motors and Ford. The actual numbers will be revealed when Stellantis reports its second-half and full-year 2023 earnings on Thursday, February 15th.

In the U.S., Stellantis sales in the fourth quarter were down 1% year over year, while the overall market was up 8%. Stellantis saw sales decline despite significantly enhanced incentives, averaging $4,404 per unit, up 166% year over year. Still, Stellantis' average trading price rose 6% to $59,292, even as other automakers' ATPs were flat, down, or barely up.

Here are some data points provided by Cox Automotive regarding Stellantis' fourth quarter market performance in the United States, one of its most important markets.

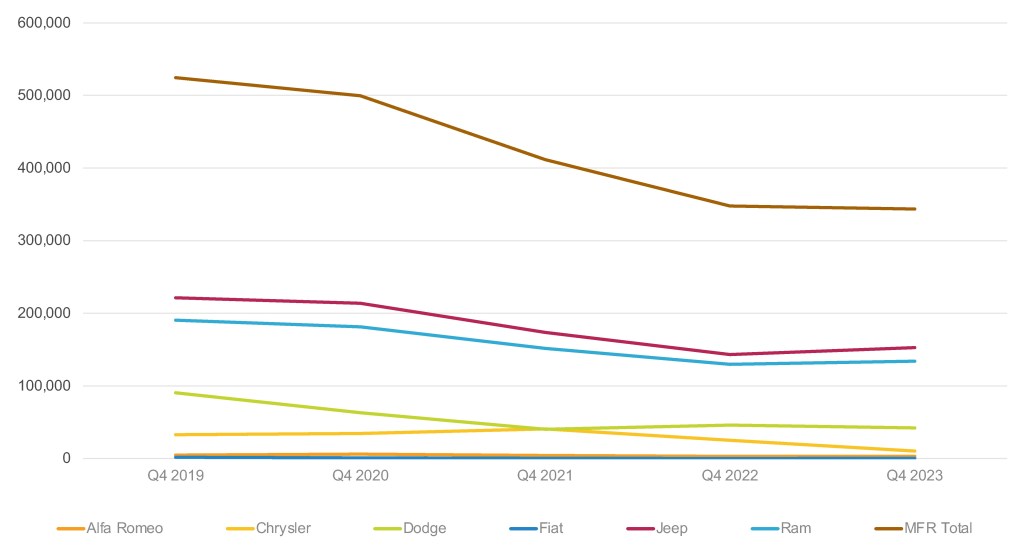

Stellantis' fourth-quarter sales fell 1% amid strong industry performance

Stellantis sold 343,552 vehicles in the fourth quarter of 2023, down 1% from a year earlier, but U.S. industry sales rose 8%, according to Cox Automotive calculations. Stellantis' fourth quarter sales were the lowest in at least five years. For comparison, Stellantis sold 524,519 vehicles in 2019.

STELLANTIS US Sales Results for Q4 2023

For all of 2023, Stellantis was the only major automaker to record lower sales than the previous year, when sales fell due to a global shortage of computer chips. In 2023, Stellantis fell behind Hyundai in the U.S. market in terms of sales.

Stellantis' mass-market brands Jeep and Ram turned things around by year's end. Dodge and Chrysler's sales were lower than the previous year. Italian manufacturers Alfa Romeo and Fiat saw an increase in sales but very low unit sales.

Jeep sales rose 7% to 152,818 units in the fourth quarter, after declining for several quarters. Nevertheless, sales remain well below historical sales levels. For comparison, the brand sold over 221,000 vehicles in the fourth quarter of 2019.

Sales of Jeep's mass-market Grand Cherokee increased by 22% to 61,723 units. Compass sales also increased by 28% to 24,613 units.

Gladiator sales fell 22% to 13,660 units, the lowest fourth-quarter sales since the pickup was introduced in 2019. Similarly, Wrangler sales were down 12% year over year to about 30,000 units, the lowest sales volume in five years. . Stellantis recently cut production at its Toledo, Ohio, factory, where both models are made, citing slow sales and a buildup of inventory.

Sales of Jeep's most expensive models, the Wagoneer and Grand Wagoneer, increased year over year. Wagoneer sales increased 39% to 8,266 units, the highest sales level for the quarter since its launch in 2021. Grand Wagoneer sales increased 9% to 2,483 units.

Stellantis has released two “cheap Jeeps'' called the Cherokee and the Renegade. Less than 1,600 Cherokees were sold in the fourth quarter. Renegade sales increased by 177% to 10,450 units as the brand's sales declined.

Ram sales rose 4% to 134,363 units, the lowest level for the quarter in five years. By the way, Ram's sales in 2019 peaked at over 190,000 units. Ram pickup truck sales rose 7% to 112,486 units, but were the second-lowest year-over-year. By comparison, Ram sold more than 172,000 pickup trucks in the fourth quarter of 2019.

Dodge sales fell 8% to 42,514 vehicles as the company sold its Challenger and Charger muscle cars, which will be replaced by electric vehicles this year. Challenger sales fell 26%. Sales of chargers fell by 30%. Durango sales decreased 2%. The new Hornet recorded sales of 4,964 units.

Sales of Chrysler brand vehicles have plummeted by 59% to 10,371 units, about one-third of what they were five years ago. Sales of the Pacifica minivan decreased by 63% to 8,356 units. Three years ago, Chrysler sold 38,821 vehicles in the same quarter.

Alfa Romeo's sales increased by 9% to 3,308 units, but it is still far from 2020's peak sales of over 6,000 units. The new Tonale contributed to sales of 1,233 units, while Giulia and Stelvio sales fell by double digits.

Fiat's sales increased by 51% year-on-year, but still only 178 units. By comparison, Fiat sold more than 3,400 vehicles in its strongest fourth quarter of 2018.

Stellantis market share drops to 8.80%

Underperforming the industry, Stellantis' market share fell to 8.80% from 9.63% a year ago, its lowest quarter in five years. In 2019, Stellantis recorded a quarterly high with a market share of 12.66%.

For both mass-market brands, this quarter's share was the lowest in at least five years. Jeep's share fell to 3.92% from 3.97% a year ago and 5.17% in 2018 and 2019. Ram's share declined to 3.44% compared to 3.60% a year ago and 4.60% in 2021.

Dodge's share fell 1.09% from 1.28% a year ago. This was more than double the number in 2018 and 2019. Chrysler's brand share plummeted to just 0.27%, compared to 0.69% a year ago, and a fraction of its 1.24% share in 2021.

Alfa Romeo and Fiat recorded little market share.

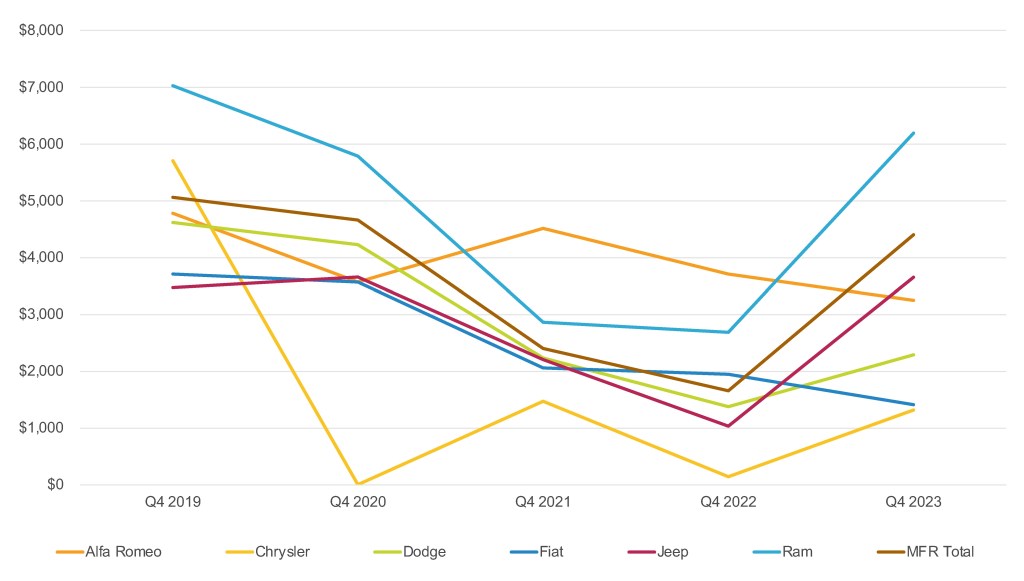

Stellantis incentives increased by 166% to $4,404 per vehicle

Stellantis increased incentives by 166% in the fourth quarter to an average of $4,404 per vehicle, according to Cox Automotive calculations. This level of incentive spending approaches what Stellantis was spending before the pandemic. That's well above the industry average of $2,511 per unit in December, according to figures from Kelley Blue Book.

STELLANTIS US Incentives for Q4 2023

Jeep had the highest incentive increases at an average of $3,657 per vehicle, compared to an average of $1,036 per vehicle in the same period last year. This was the highest average price per Jeep since 2021, when it was just $3 more expensive.

Ram more than doubled incentives to an average of $6,129 per vehicle, the highest amount since 2021, when they exceeded $7,000. Dodge spent an average of $2,293 per vehicle, an increase of 66%. Chrysler's average incentive was $1,320, up significantly from $145 a year earlier, but well below the pre-pandemic range of $5,500 to $6,000.

Alfa Romeo and Fiat have lowered their incentives. Alfa Romeo reduced its incentives by 12% to an average of $3,251. Fiat's incentives fell by 27% to an average of $1,414 per car.

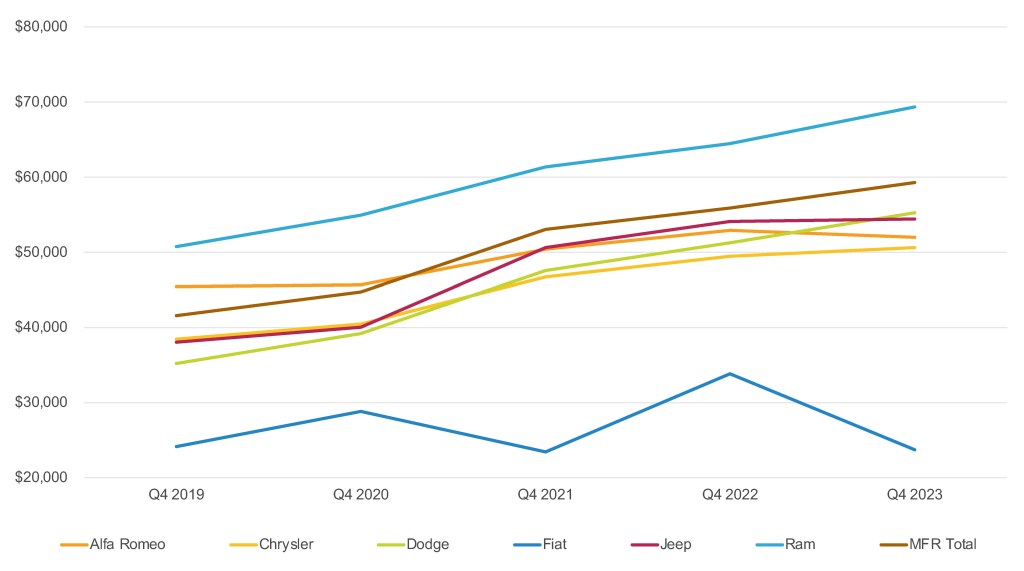

Stellantis ATP rose 6% to $59,292

According to Cox Automotive calculations, Stellantis recorded a significant increase in average transaction price (ATP). While most automakers saw only small or flat to negative ATP increases, Stellantis' fourth-quarter ATP rose 6% to $59,292, leading to a 6% increase in ATP for Ford and General. The level far exceeded that of Motors. This is the highest amount of the quarter and significantly exceeds the $41,578 in Q4 2019. According to Kelley Blue Book, ATP in the fourth quarter was also well above Stellantis' US average of $48,759 (down 2% year-over-year).

Stellantis US average trading price for Q4 2023

Ram was the biggest gainer, increasing 10% to $66,987. Ram pickups increased 8% to $69,369. Promaster Commercial Vans saw an ATP increase of 13% to $55,182.

Jeep's ATP was almost flat at $54,434. Various models were flat, down, or up by low single digits. Jeep's most expensive model, the Grand Wagoneer, saw a slight increase in ATP to $102,669. The ATP for the Wagoneer was $76,965. There are no cheap Jeeps from this brand anymore. Currently, the cheapest model is the Compass, with an ATP of $37,412, nearly $9,000 more than in 2019.

Dodge's ATP rose 8% to $55,264 as buyers scooped up a special edition model of the last gasoline-powered muscle car. The Challengers' ATP rose 21% to $62,651. The Chargers' ATP rose 3% to $49,614. The Durango rose nearly 10% to $59,737. The new Hornet is Dodge's least expensive model, with an ATP of $41,555.

Chrysler brand ATP fell 2% to $50,621. ATP for the Pacifica minivan rose 2% to $51,413. The discontinued 300 rose 13% to $47,455.

Fiat's ATP plummeted 30% to $23,701. Alfa Romeo fell 2% to $51,997.

Michelle Krebs

executive analyst

Michelle Krebs is an automotive analyst and award-winning writer with more than 35 years of experience covering the global automotive industry. For the past eight years, she has provided analysis and insight into the automotive industry using a wealth of consumer and industry data from Cox Automotive and its brands, including Autotrader and Kelley Blue Book.