Overview of recent trades for Jim Simons (Trades, Portfolio)

On December 29, 2023, Renaissance Technologies, led by Jim Simmons (Trades, Portfolios), reported a decrease in its holdings in Nicholas Financial, Inc. (NASDAQ:NICK). The transaction included the sale of 8,025 shares at a price of $6.90 per share. Following this transaction, the Company's total holdings in Nicholas Financial now total 351,951 shares. Despite the reduction, the position still represents 4.83% of Simmons' portfolio.

Jim Simons (Trades, Portfolio) and Renaissance Technologies: Brief Profile

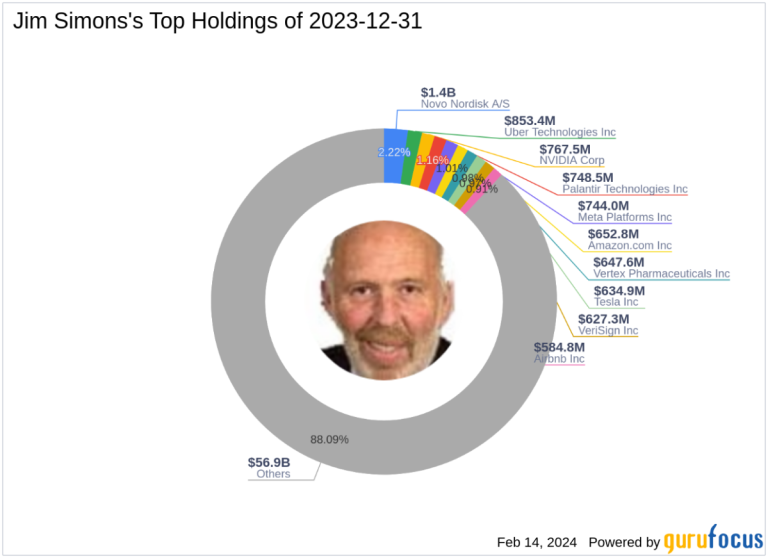

Jim Simmons (Trading, Portfolio), founder of Renaissance Technologies, has been a prominent figure in the investment world since 1982. The company is known for its quantitative, data-driven approach that utilizes complex mathematical models to predict market movements. Renaissance Technologies is a pioneer in the use of high-frequency trading and has a reputation for scientific and statistical analysis of market trends. The company's major holdings include Meta Platforms, Inc. (NASDAQ:META), Nvidia Corporation (NASDAQ:NVDA), and Novo Nordisk A/S (NYSE:NVO), with a focus on technology and healthcare. is focused on. The company's capital is worth $64.61 billion.

Overview of Nicholas Financial Inc.

Nicholas Financial Inc., which trades in the United States under the symbol NICK, has been a player in the specialty consumer finance market since its IPO on December 30, 1997. The company's main activities include acquiring and servicing auto financing installment contracts. and used vehicles. In addition, Nicholas Financial provides direct consumer loans and sells related financial products. The company operates as a single segment and derives the majority of its revenue from interest and fee income.

Detailed specifications of the transaction

A recent trade by Jim Simons (Trading, Portfolio) decreased Nicholas Financial's holdings in the company by 2.23%, but did not have a material impact on the overall portfolio as the trade had a trading impact of 0%. The trading price was set at $6.90, and the current total number of shares held is 351,951 shares, reflecting a 4.83% position in the company.

Nicholas Financial Financial Snapshot

Nicholas Financial Inc. has a market capitalization of $51,099,000 and is considered moderately overvalued, with the current stock price hovering around $6.9,999, according to GuruFocus' GF Valuation. His GF value of this stock is calculated to be $6.23, giving a price to GF value ratio of 1.12. Notably, the company's PE ratio has not been applied, indicating that it is currently operating in the red.

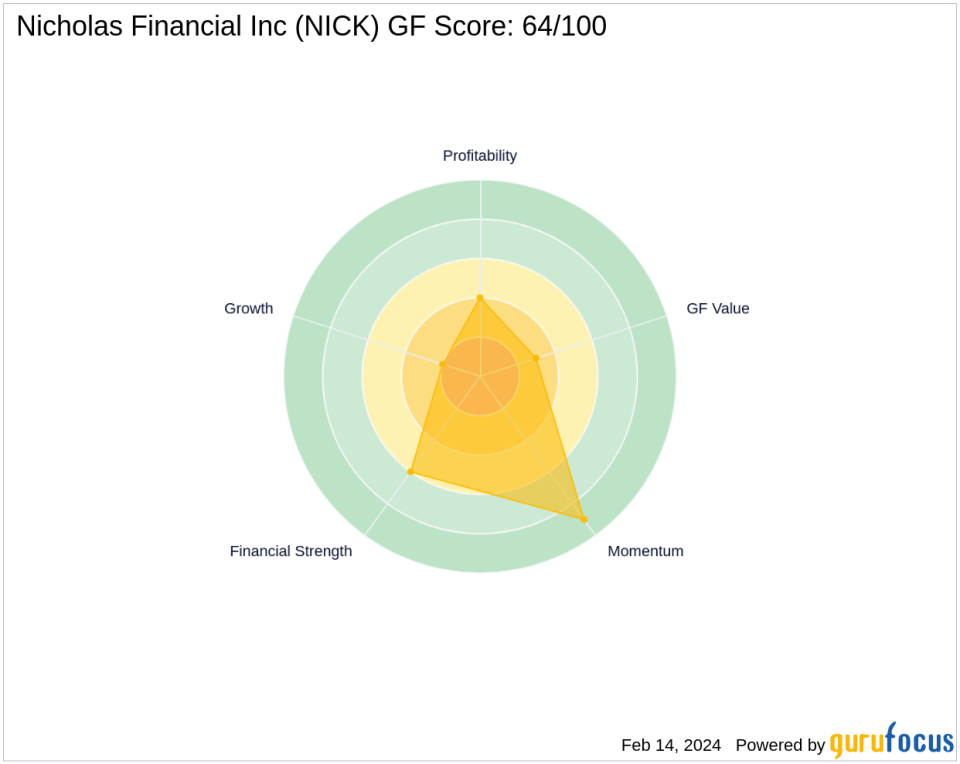

Stock performance and ranking

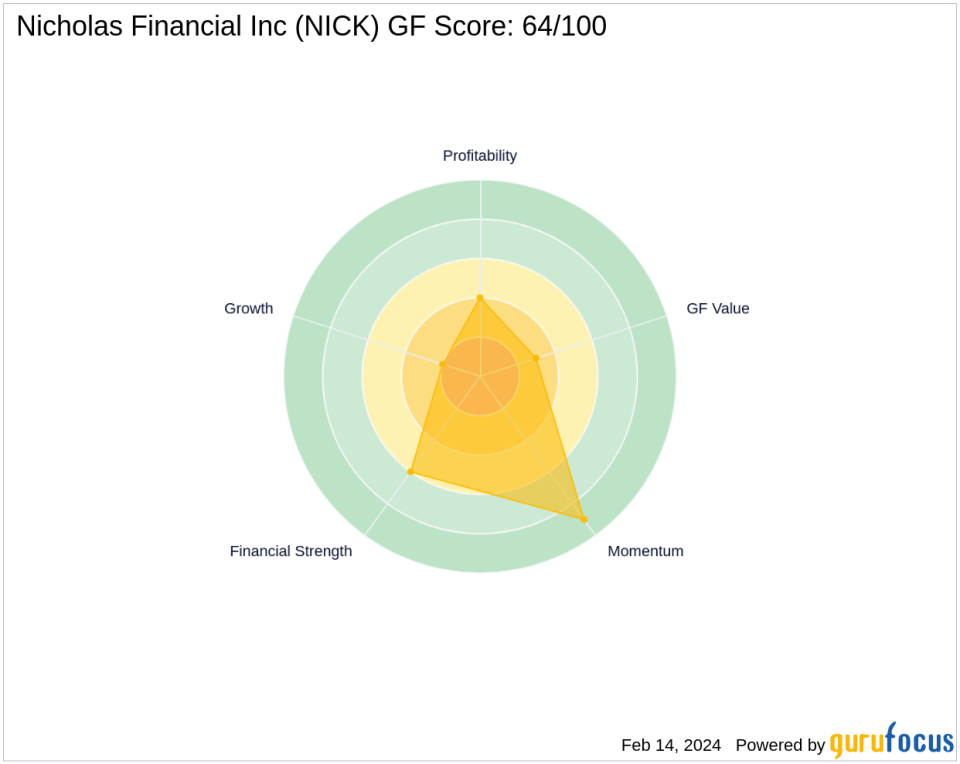

Since its IPO, Nicholas Financial's stock price has changed by 284.61%. However, cumulative annual results are not included. Since this transaction, the stock price has increased by 1.45%. His GF in the company has a score of 64/100, indicating a low potential for future performance. Nicholas Financial's financial strength and profitability ranks are 6/10 and 4/10, respectively, while his growth rank and his GF value rank are lower at 2/10 and 3/10. Momentum Rank is high at 9/10.

comparative sector analysis

Jim Simmons (Trades, Portfolios)'s major sector holdings are primarily in technology and healthcare, as opposed to Nicholas Financial's credit services industry. Nicholas Financial's position within the sector is influenced by a variety of factors, including financial strength, profitability, and growth prospects.

Future outlook and its impact

The decision by Jim Simmons (Trades, Portfolio) to reduce his holdings in Nicholas Financial may be influenced by the company's current financial metrics and market valuation. For value investors, this move could signal a reassessment of the company's stock potential given its moderate overvaluation and the company's investment philosophy. While the transaction's impact on the stock and Simmons' portfolio appears minimal, it highlights the importance of continually evaluating investment positions.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.