It's easy to buy index funds these days, and your returns should (mostly) match the market. However, if you choose the right individual stocks, you can earn even more. In other words, Kratos Defense & Security Solutions Co., Ltd. (NASDAQ:KTOS) stock is up 59% from a year ago, far better than the market return of approximately 21% (not including dividends) over the same period. By our standards, this is a solid performance. Unfortunately, long-term returns haven't been as good, with the stock price down 44% over the past three years.

After the big rally over the past week, it's worth checking whether the long-term returns are driven by improving fundamentals.

Check out our latest analysis for Kratos Defense & Security Solutions.

In Buffett's words, “Ships will sail around the world, but a flat-Earth society will thrive.'' There will continue to be a wide discrepancy between prices and values in the marketplace. ..' One imperfect but simple way to consider how the market perception of a company has changed is to compare the change in the earnings per share (EPS) with the share price. price movement.

Kratos Defense & Security Solutions was able to grow its EPS by 38% over the last twelve months. However, we note that unusual items impacted revenue. The share price increase of 59% certainly outpaced the EPS growth. So it's fair to think the market has a higher valuation for this business than it did a year ago.

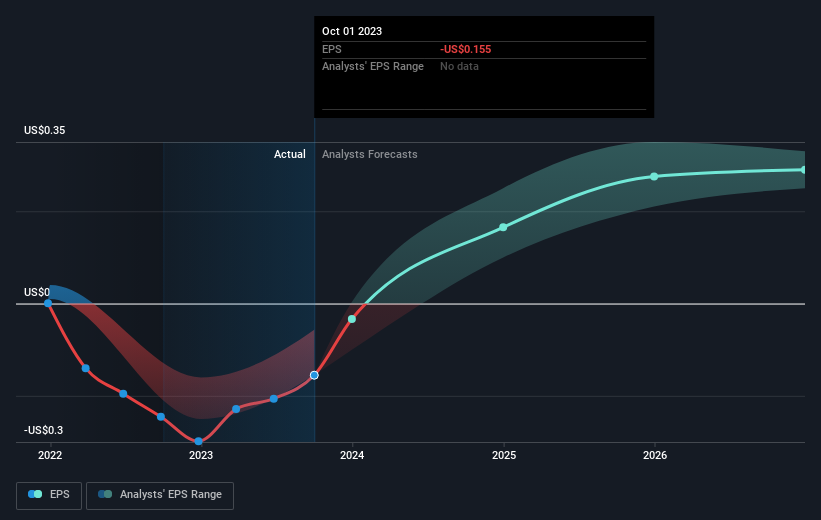

The image below shows how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Kratos Defense & Security Solutions has improved its earnings lately, but will it grow? free A report showing analyst revenue forecasts can help determine whether EPS growth is sustainable.

different perspective

We're pleased to report that Kratos Defense & Security Solutions shareholders have received a total shareholder return of 59% over one year. The stock's 1-year TSR is better than his 5-year TSR (the latter at 1.5% per annum), so it looks like the stock has performed better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don't miss out. It's always interesting to track stock performance over the long term. However, to understand Kratos Defense & Security Solutions better, you need to consider many other factors. Still, note that Kratos Defense & Security Solutions shows that: 2 warning signs in investment analysis you should know…

However, please note: Kratos Defense & Security Solutions may not be the best stock to buy.So take a look at this free A list of interesting companies that have grown their earnings in the past (and are predicted to grow in the future).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we help make it simple.

Please check it out Kratos Defense and Security Solutions Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.